María Alejandra Amado – Economist – Department of International Economics and Euro Area, Bank of Spain

Iader Giraldo – Lead economics researcher at Latin American Reserve Fund (FLAR).

The volatility of international capital flows has increased in recent months due to various circumstances, such as the accelerated withdrawal of monetary stimulus in developed economies, geopolitical conflicts, and slowing demand, among many other factors[1]. Latin America has been no exception: 2022 has been characterized by lower bond issuance, higher indebtedness, greater risk aversion, and higher spreads. On November 2, 2022, Pablo Guidotti, plenary professor at Torcuatto Di Tella University; Martín Castellano, head of Latam research at the Institute of International Finance (IIF); and María Paola Figueroa, head of Latam frontier research at the IIF presented their views on capital flows to Latin America in the current global economic environment. The panelists analyzed the issue from the perspectives of academia and the private sector in a webinar jointly organized by the Bank of Spain and the Latin American Reserve Fund (FLAR, 2022), and their messages can be summarized as follows.

2022 has been a complex year for emerging and developing countries due to various global economic and geopolitical shocks. All this has generated a high level of uncertainty in capital markets. Within this combination of variables, the reappearance of inflation is perhaps the most important economic phenomenon affecting the various countries. Fundamentally, this is because inflation is occurring simultaneously throughout the world, compromising both advanced and developing countries, as well as their economic policymakers who must dictate rules for its control.

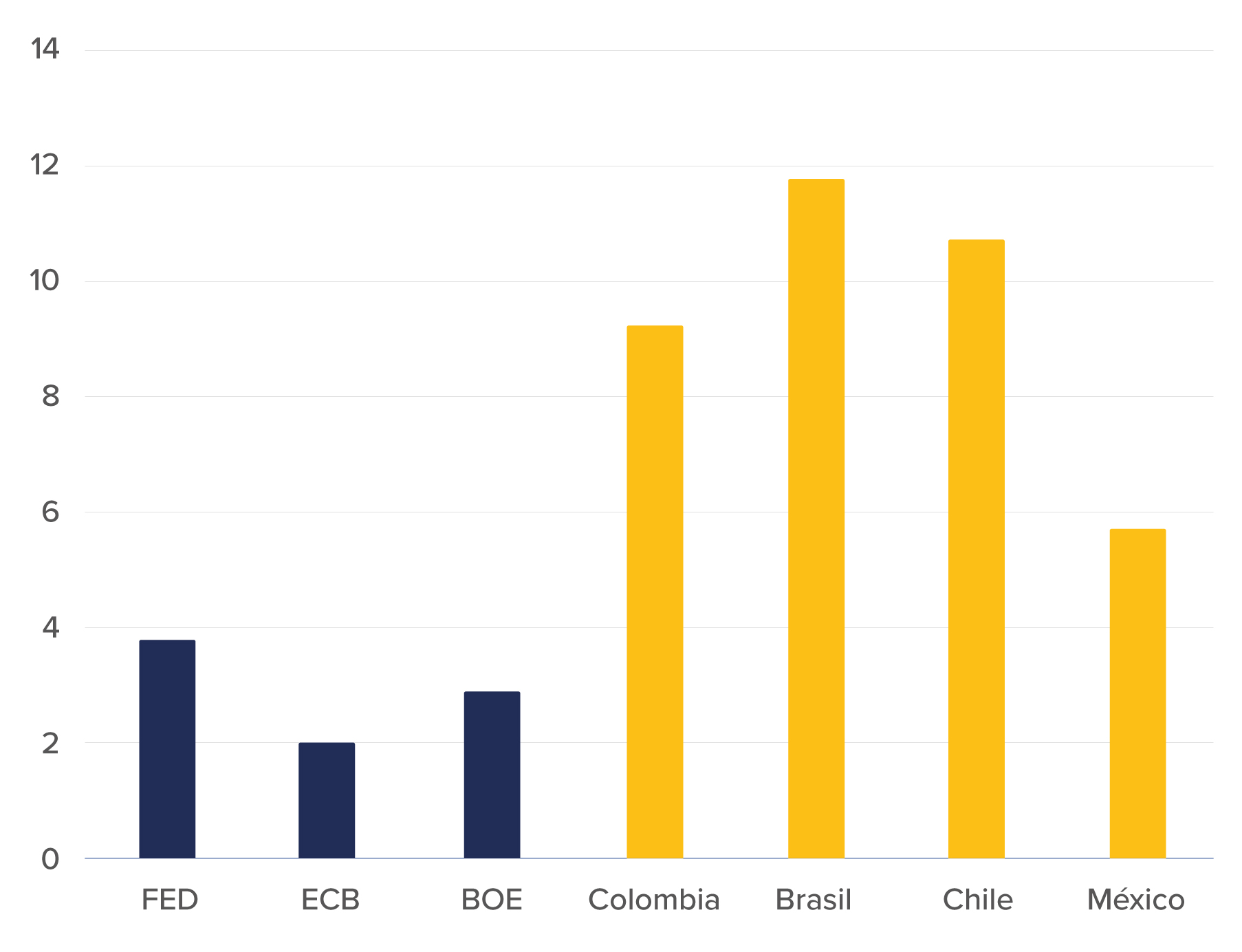

At the regional level, although inflation levels are high, the commitment of most of the central banks that have acted swiftly in withdrawing the monetary stimuli implemented during the pandemic to control the price level is noteworthy (Figure 1). In this respect, Mexico and Brazil are worth highlighting: their banks began contractionary policies at the end of 2021 and have controlled price levels fairly well. In contrast, several developed countries seem to have initially fallen behind the curve and have been cutting spending with a stricter tightening policy that has direct effects on Latin American economies.

The tightening of global financial conditions as a result of monetary policy decisions in developed economies has begun to affect the post-pandemic economic recovery. However, higher commodity prices have helped to offset some of this effect in producer countries, improving their external revenues and providing them with greater fiscal space. Latin America’s performance has been outstanding compared to other emerging countries.

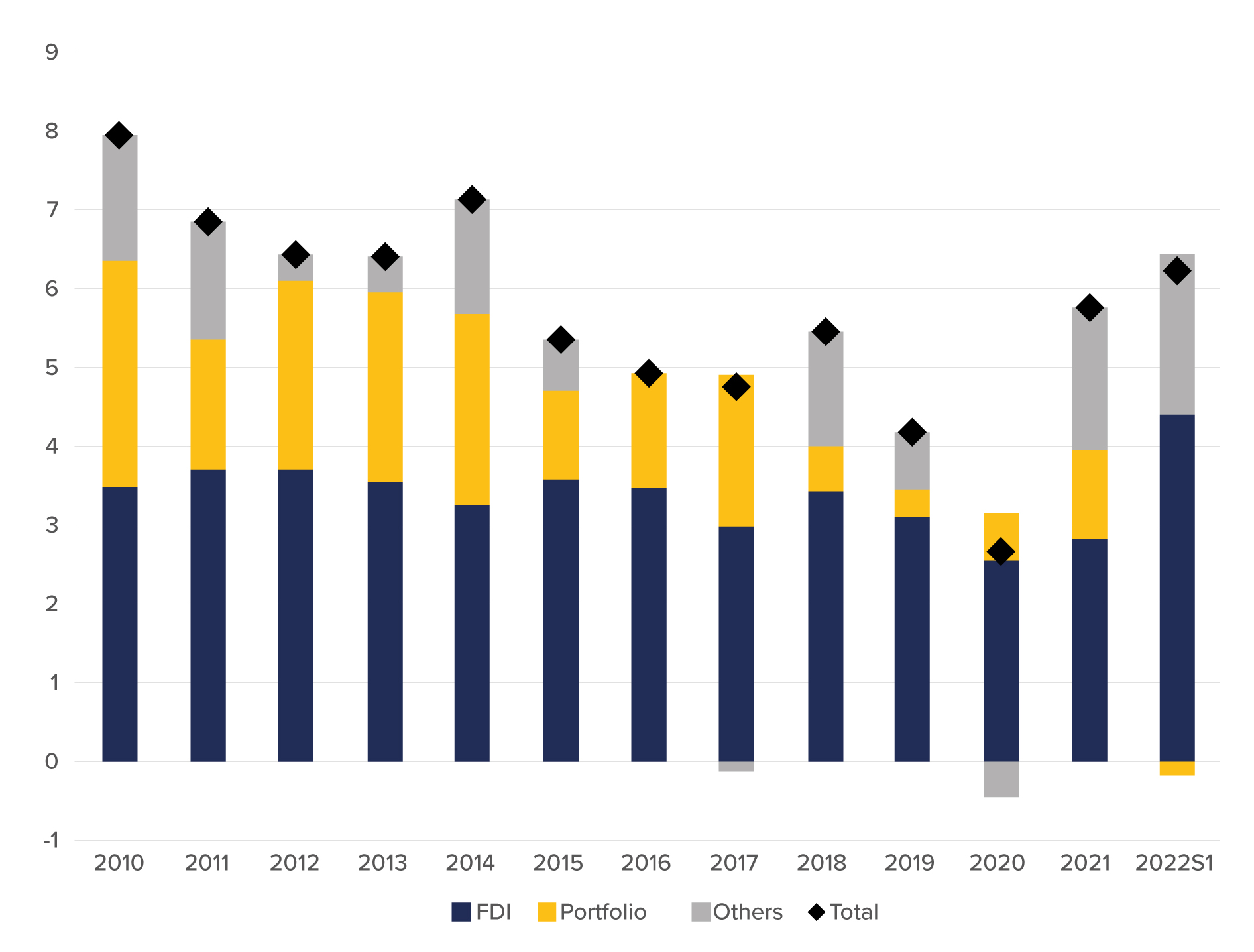

Capital flows to the region have been moderating due to these tighter international financial conditions and not due to crises or shocks in the emerging economies themselves; there has not been a credit trigger as on previous occasions. This reduction is mainly reflected in lower portfolio investment. On the other hand, foreign direct investment and loans have continued to flow significantly to the region. The latter, in part, is due to better commodity prices and more significant investment opportunities in the mining and energy sectors, which actually doubled the flows received last year.

Interest rate spreads, the depreciation of most currencies, and the rebalancing of investors’ portfolios away from Europe and China are additional factors that have favored the region’s position vis-à-vis other emerging markets, allowing for continued capital inflows. However, there is a risk-aversion factor that has caused many international investors to seek “safe” refuge for their capital in developed economies, mainly the United States, while uncertainty levels in the global economy are reduced.

Figure 2: Capital Flows to Latin America (%GDP)

Source: Authors’ elaboration based on IMF data. Note: We consider the largest economies and/or those with more data: (Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico and Peru). 2022H1: The first half of 2022.

The short- and medium-term outlook suggests moderate capital flows to the region with a low probability of sudden stops if the conflict in Europe does not escalate and there are no other exceptional economic shocks. However, the situation is not homogeneous for all countries, and idiosyncratic elements will be critical determinants of the volatility of these flows in each economy.

The challenges ahead for the different Latin American countries are significant due to high levels of public and private indebtedness – a product of the policies adopted during the pandemic, less fiscal space, and the inflationary phenomenon that has been occurring. However, the outlook for the future is positive, given that countries are better prepared for this type of crisis and have learned from past events. In particular, stability in terms of economic policy has been a factor in containing social conflicts and political crises in several countries in the region, which external investors have internalized. Furthermore, the global financial safety net is much more robust; both the International Monetary Fund and regional financial funds, such as FLAR, are better prepared and have better mechanisms to respond to possible eventualities that may arise from the current global economic environment.

The opinions in this document are the authors’ sole responsibility and do not commit to FLAR, the Bank of Spain, or its directory board.

References

FLAR (November 2-2022) FLARTalks. “Capital flows to Latin America in the current global economic environment”