Carlos Giraldo – Chief economist FLAR – Latin American Reserve Fund

Iader Giraldo – Lead researcher FLAR – Latin American Reserve Fund

Central bank digital currencies (CBDCs) have gained prominence in recent years, especially in the wake of the pandemic . However, there is no unique design of a CDBC, with as wide varieties of CDBCs as animal species within the oviparous species. It is critical to understand this difference before discussing this kind of currency because, following the analogy, discussion scenarios may arise where someone could be talking about a parrot and someone else a turtle; just because they are born from an egg does not make them the same (Figure 1).

Figure 1. Different types of CBDCs

The first classification to be made about CBDCs is whether they are for retail (retail-CBDC) or wholesale (wholesale-CBDC) transactions. This difference depends on the currency for transactions within or between countries. It would be like the initial classification of animals when they are born, between viviparous and oviparous. In this post, the focus is on CBDCs for retail transactions, as they seem to have more potential for implementation in the central banks of emerging and developing countries, as they are not issuers of reserve currencies, Cheng (2022).

When implementing a CBDC, central banks must determine multiple aspects of its design that will have implications for its operability, monetary policy, and countries’ macroeconomic and financial stability. The main ones are architecture, monetary policy tools, identity in transactions, information management, adaptability, and financing. From the differentiated combination of these variables, a large number of CBDCs can emerge, whose only common factor may be that they are digital and issued by a central bank (that is, hatched from an egg, Figure 2).

The architecture has to do with the type of nodes in the network and who manages them. This can be direct, where the central bank acts as the central node that manages the data and transactions made with the currency, or indirect, where there is an intermediary between the users and the central bank, usually the commercial banks, Auer, R., and Böhme (2020). In short, the architecture defines the responsibilities of all financial actors within the network.

Following this, the role of CBDC as a monetary policy instrument of central banks must be determined. Thus, the design of this type of digital currency can be cash-like, increasing financial inclusion and making payment systems more efficient. Or it can be deposit-like, allowing central banks to implement monetary policy measures more broadly and quickly but, in turn, taking on the partial role of a commercial bank.

Figure 2. Different choices in designing a CBDC

Identity in CBDC transactions determines whether they are carried out between users, as they are usually done, with names and agent IDs, or between codes (tokens) linked to a portfolio of assets held by the agents, which has advantages in terms of privacy but generates costs in terms of transaction speed. In line with this, when designing a CBDC, it is necessary to define how all the information generated by the transactions carried out by this system will be handled. There is a clear trade-off between transparency and privacy. The former would allow better traceability of transactions, but at the same time, it could violate the privacy of individuals providing large amounts of data.

All of the above converges to determine the degree of adaptability of CBDC to the current financial system. That is, does CBDC become part of the existing financial system as an additional type of currency, or is it a disruptive change that would radically modify the current system? Moving toward the former would allow for keeping the risk diversified with part of the regulation established to date and a more gradual adaptation toward this type of currency. In contrast, moving more toward the latter could lead to uncharted territory in which central banks would have the functions of commercial banks.

The source of CBDC financing must also be defined and has to do with several aspects mentioned above. It can be financed by the central bank, commercial banks, users, or public‒private partnerships. These large-scale projects require many economic resources, so this is not an easy factor to determine.

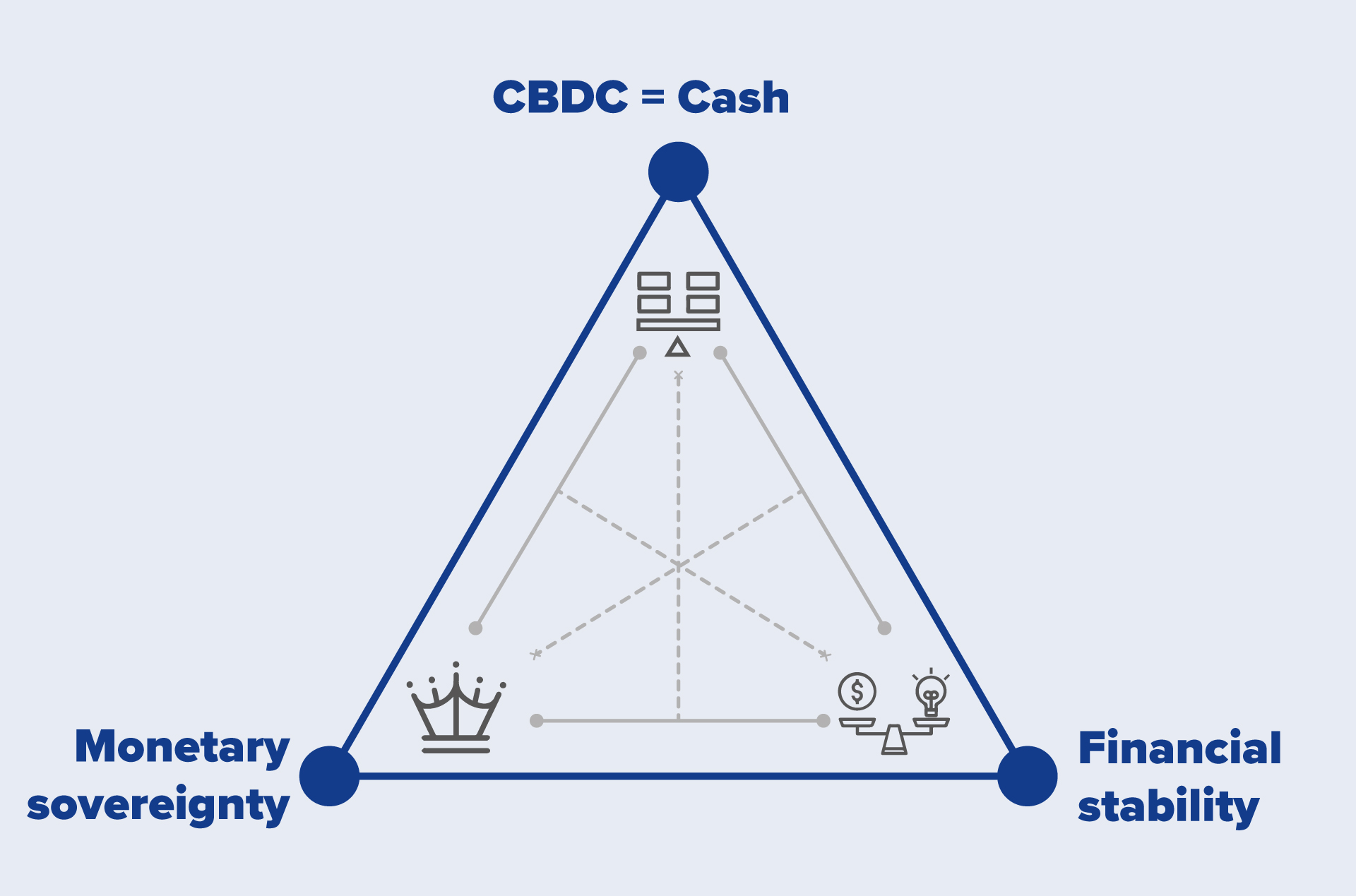

Choices about the different dimensions of the design of CBDCs have effects on their operability and, fundamentally, on monetary policy and the macroeconomic and financial stability of countries. To date, different CBDC designs are being implemented worldwide, and there are few data on the implications. A preliminary analysis suggests the existence of a new impossible trinity after implementing CBDCs (Figure 3), which has three distinct angles: one-to-one parity between digital currency and cash, monetary sovereignty (central banks control the issuance of money), and financial stability (risk is diversified among multiple nodes preventing bank runs), of which central banks would only be able to guarantee two (Bjerg, 2017 and Yang and Zhou, 2022).

Figure 3. CBDC’s impossible trinity

The path toward the design of CBDCs has multiple challenges, from the essential components of their architecture, regulation, and implementation, to the implications for monetary policy and macroeconomic and financial stability. It is imperative to safeguard the latter in the long road ahead and to be clear that central banks’ determinations in all dimensions results in different types of CBDCs, perhaps as many as the oviparous species, but that does not mean just because they hatch from an egg, they are a bird.

The opinions contained in this document are the authors’ sole responsibility and do not commit FLAR or its directory board. We thank the assistance of Mateo Hernández in this post.

References

Auer, R., & Böhme, R. (2020). The technology of retail central bank digital currency. BIS Quarterly Review, March.

Bjerg, O. (2017). Designing new money-the policy trilemma of central bank digital currency.

Cheng, P. (2022). Decoding the rise of Central Bank Digital Currency in China: designs, problems, and prospects. Journal of Banking Regulation, 1-15.

Yang, J., & Zhou, G. (2022). A study on the influence mechanism of CBDC on monetary policy: An analysis based on e-CNY. Plos one, 17(7).