Carlos Giraldo – Chief economist at Latin American Reserve Fund (FLAR).

Iader Giraldo – Lead researcher at Latin American Reserve Fund (FLAR).

Philip Turner – University of Basel and former Deputy Head of MED at Bank for International Settlements (BIS).

To gain a deeper understanding of this topic, we utilized the International Monetary Fund’s (IMF) database, which covers 196 countries and spans from 1980 to 2021. This resulted in approximately 7,000 global observations, with 1,300 of those being in Latin America. We employed these data points and additional control variables to construct panel data regressions, weighted by each country’s GDP. This allowed us to create several sub-samples of countries to compare the relationship between oil prices and economic growth in Latin America with other regions.

The striking preliminary conclusion was that oil price increases over the current and the previous two years had no direct impact on GDP growth in Latin America as a whole. This is surprising given the strong effect of oil prices on real GDP in advanced economies. But we also found that growth in Latin America depends more on advanced economies’ growth than other regions. We found that the elasticity of Latin America growth to GDP growth in the advanced economies was 1.4. There is significant variation in this elasticity within the region, with Brazil’s elasticity only about 0.5.

Hence the region would be more sensitive to a world recession induced by higher oil prices (or other causes). This indirect effect of higher oil prices could be significant.

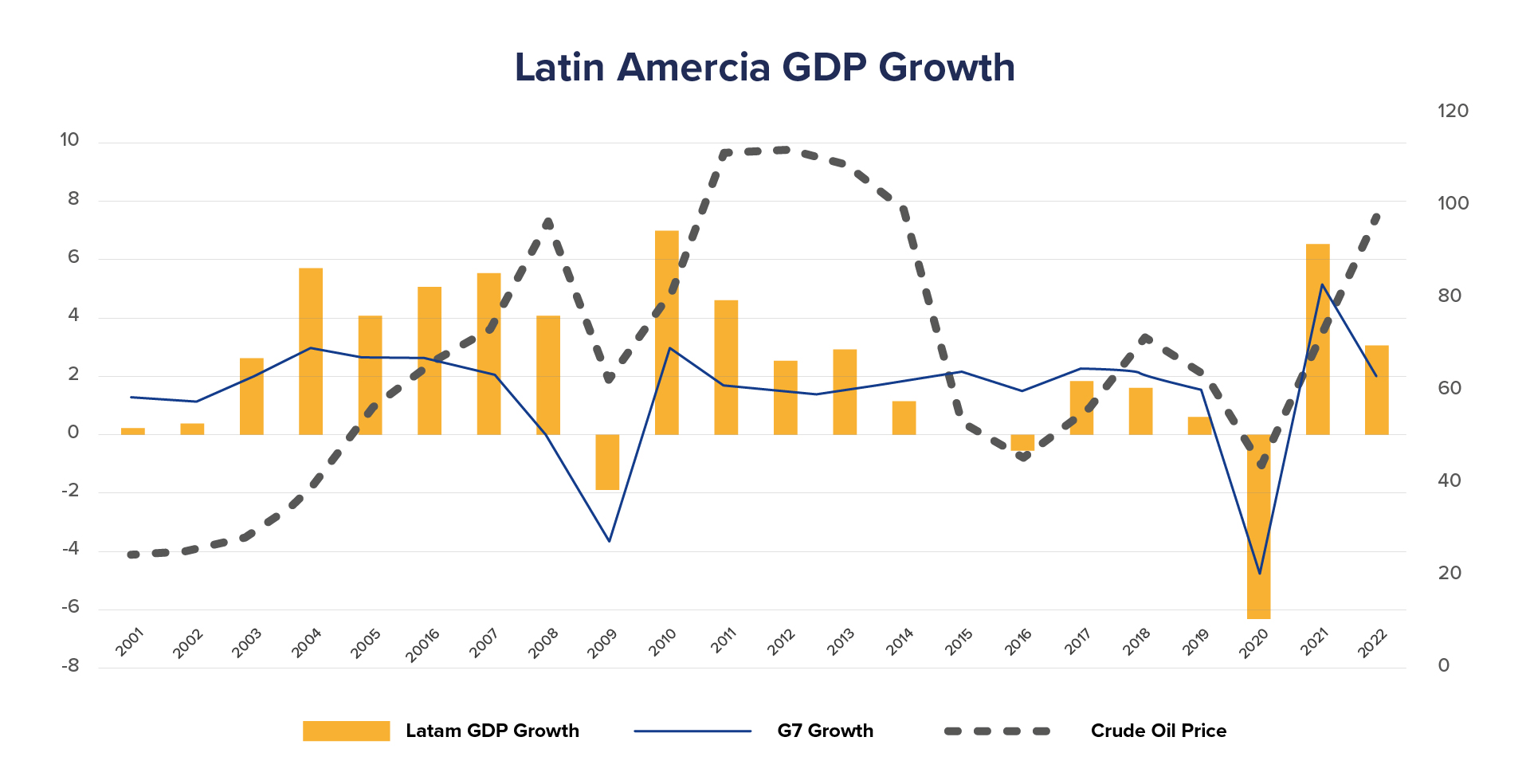

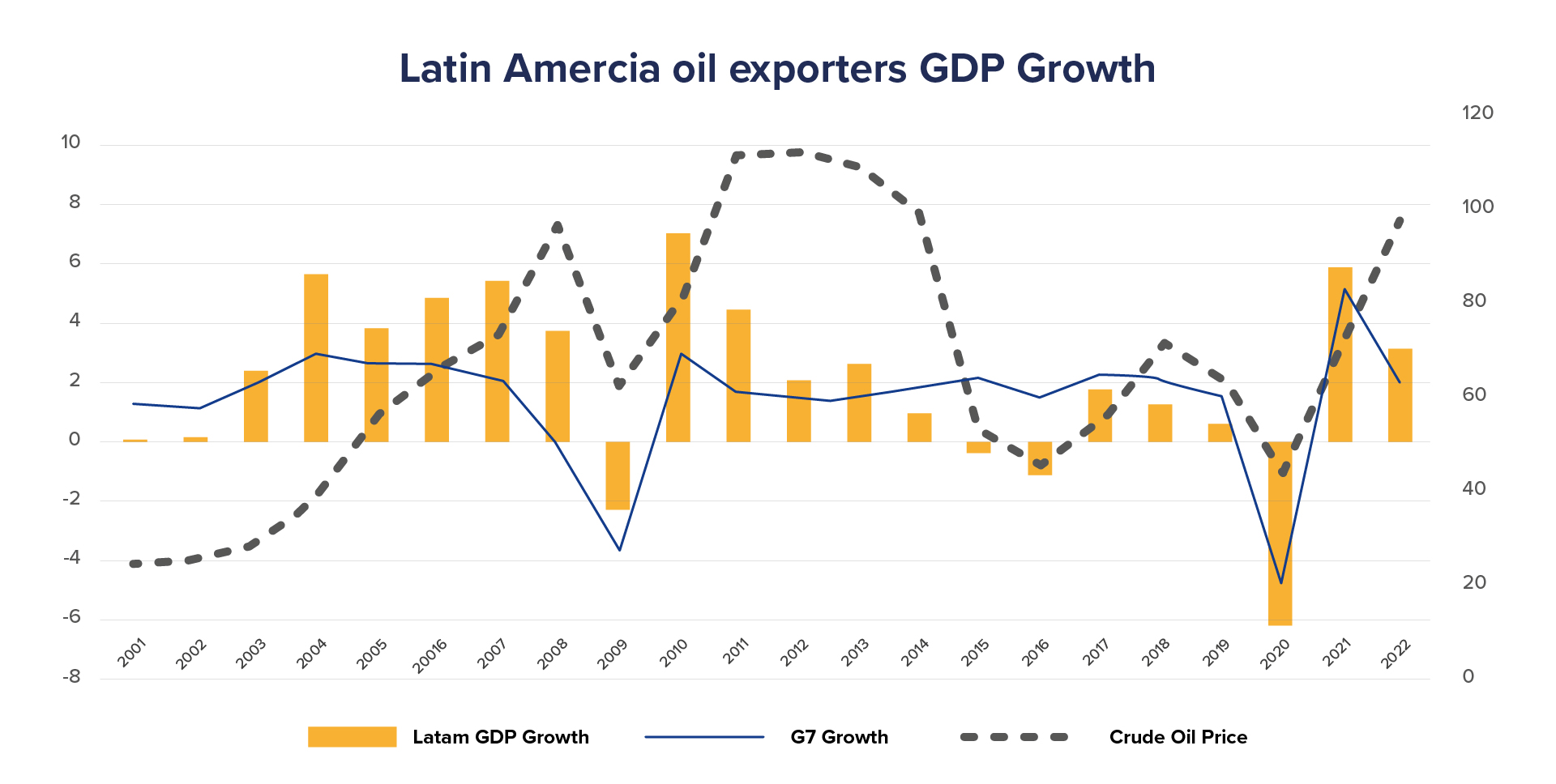

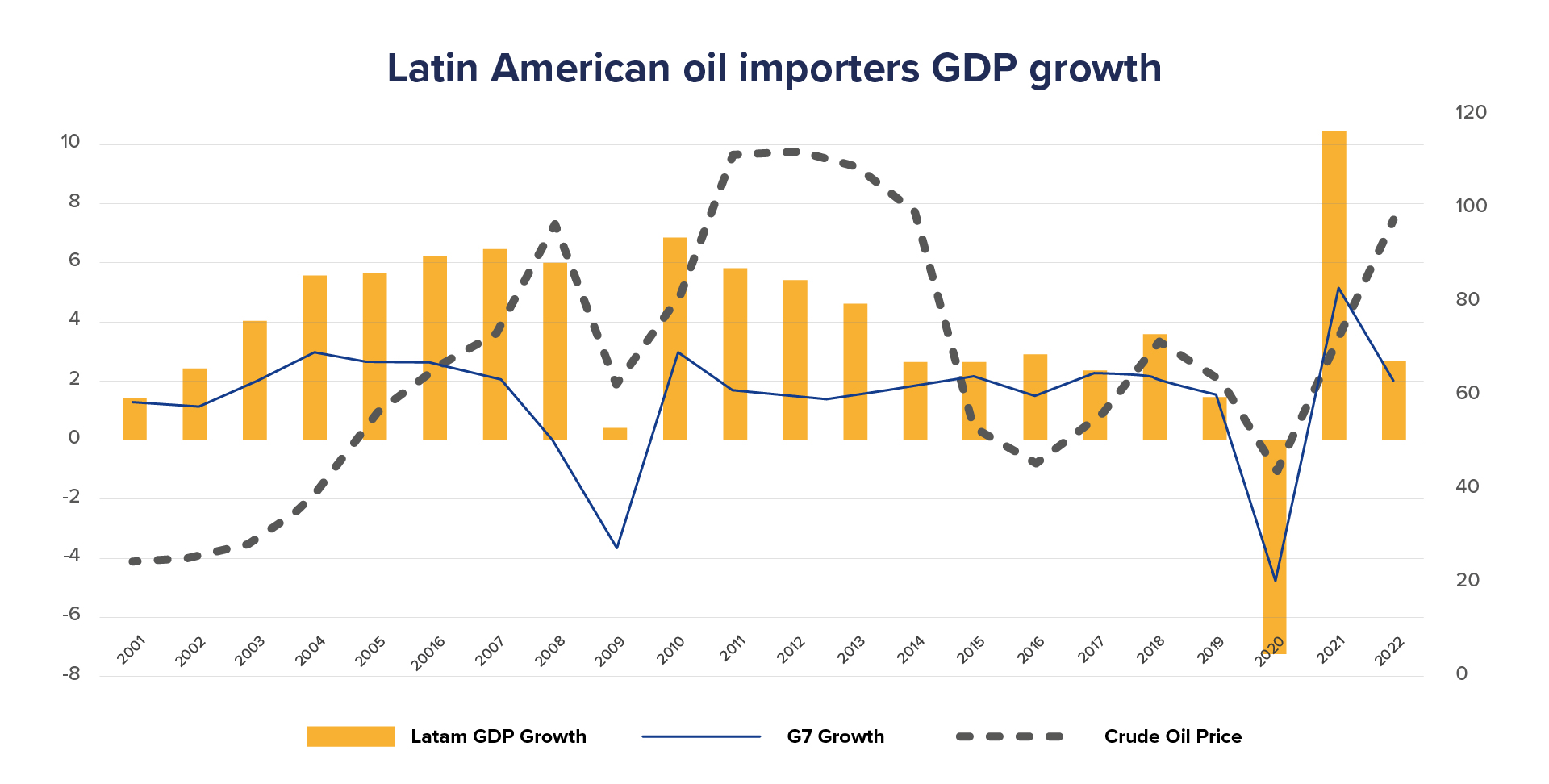

Graphical analysis supports our initial econometric findings. Figure 2 charts Latam GDP growth rates over the past 20 years (shown as bars) against advanced economy GDP growth and the annual average of oil prices. The sample is split into Latam net oil exporters and net oil importers in the middle and bottom panels of the graph. GDP growth in the advanced economies boosts the region’s different exports (which go well beyond commodities).

Figure 2: Latam GDP growth vs. Advanced economies GDP growth and oil prices

Source: Own elaboration based on IMF data.

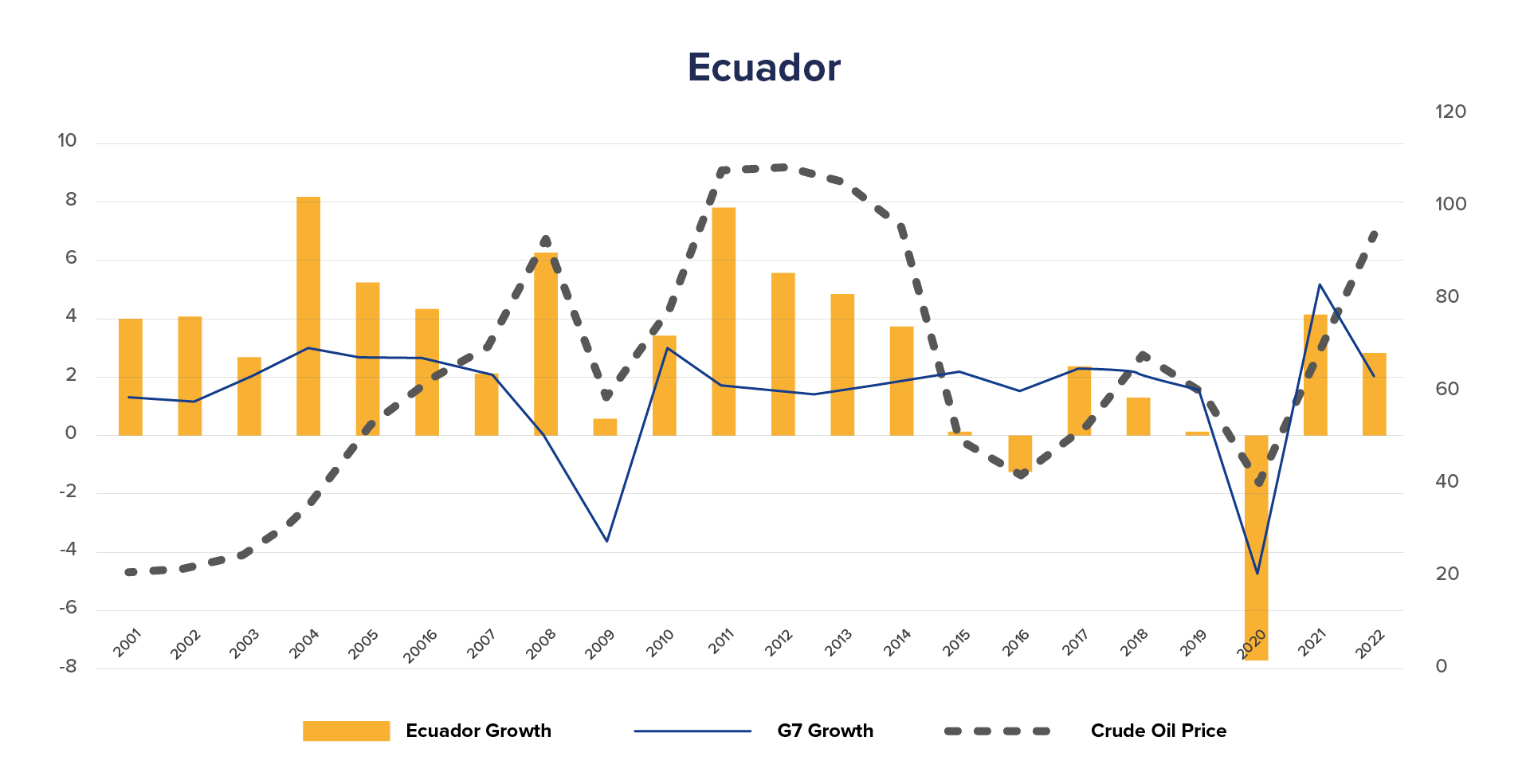

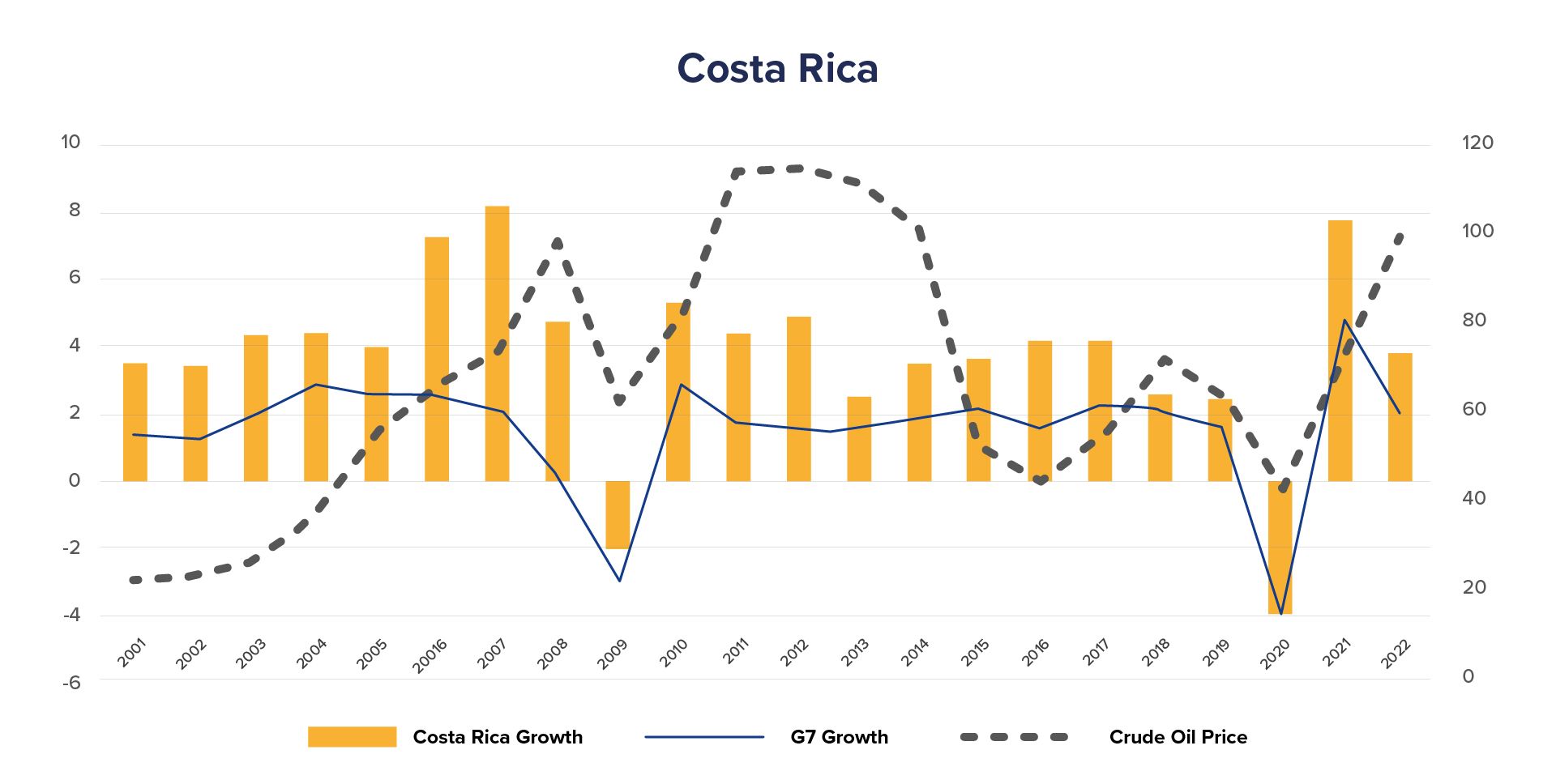

Some countries in Latam are more dependent on oil prices than others. Figure 3 depicts the same series for Ecuador, a net oil exporter (where oil exports average 47% of total goods exports), and Costa Rica, a net oil importer (where oil imports average 10% of total goods imports). In the case of Ecuador, oil prices play a crucial role in determining its GDP (marked after 2007), given the concentration of production and export on this commodity. This is not the case for other oil-exporting countries which are larger and have a more diversified structure of exports (for example, Brazil, and Mexico). In these countries, it is GDP growth of advanced economies which has a greater influence on their GDP growth. The case of Costa Rica is similar to the region as a whole, and its oil trade deficit does not generate an evident inverse correlation with its GDP growth. The G7 GDP growth is more closely related to Costa Rica’s GDP growth.

Figure 2: Latam GDP growth vs. Advanced economies GDP growth and oil prices

When comparing Latam to other regions of emerging countries, we have found that GDP growth in emerging markets as a group is stimulated by higher oil prices, primarily due to higher growth in fuel exporters. Higher world oil prices also stimulate growth in the 11 fuel exporters in Latam, but the magnitude is more limited. Although higher oil prices do boost GDP growth in Latin American fuel exporters, the impact is comparatively modest. This could be attributed to a smaller share of oil in Latin American exports compared to other emerging regions. Furthermore, the impact in Latin America is observed with a two-year delay.

Our ongoing research indicates that Latin American countries which export non-fuel commodities also benefit from higher prices of these primary commodities, which tend to move in tandem with oil prices.2 Nonetheless, the sensitivity of growth to world non-fuel prices is smaller than in other emerging markets.

1/ We refer to Latin America in the text as the set of following countries: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Paraguay, Peru, and Uruguay, which represent 96% of Latam GDP on average (IMF, 2022)

2/ The International Monetary Fund’s (IMF) index of nonfuel primary commodities serves as an aggregate measure of price movements.

The opinions in this document are the authors’ sole responsibility and do not commit to FLAR, the Bank of Spain, or its directory board.

References

FLAR (November 2-2022) FLARTalks. “Capital flows to Latin America in the current global economic environment”