Authors:

Carlos Giraldo, Latin American Reserve Fund, Bogotá, Colombia. Email: cgiraldo@flar.net

Iader Giraldo, Latin American Reserve Fund, Bogotá, Colombia. Email: igiraldo@flar.net

Jose E. Gomez-Gonzalez, Department of Finance, Information Systems, and Economics, City University of New York – Lehman College, Bronx, NY, USA. Email: jose.gomezgonzalez@lehman.cuny.edu – Visiting Professor (Summer School), Escuela Internacional de Ciencias Económicas y Administrativas, Universidad de La Sabana, Chía, Colombia.

Jorge M. Uribe, Faculty of Economics and Business, Universitat Oberta de Catalunya, Barcelona, Spain. Email: juribeg@uoc.edu

Sovereign risk is a critical element in understanding international capital flows. Investors carefully consider the default risk they face when making short- and long-term investments in a foreign country, especially when dealing with emerging or low-income countries where information is opaque and lending is subject to more significant informational asymmetries. For this reason, determinants of sovereign risk have been widely studied before.

Several papers examine this topic through different approaches. However, a shared characteristic among these previous studies is using linear models to identify the primary drivers of country risk. While some have incorporated the nonlinear impact of specific variables or variable groups, assuming particular functional forms, the underlying models remain linear, failing to fully capture potential nonlinear relationships that could be critical to understanding the sovereign risk’s determinants over time.

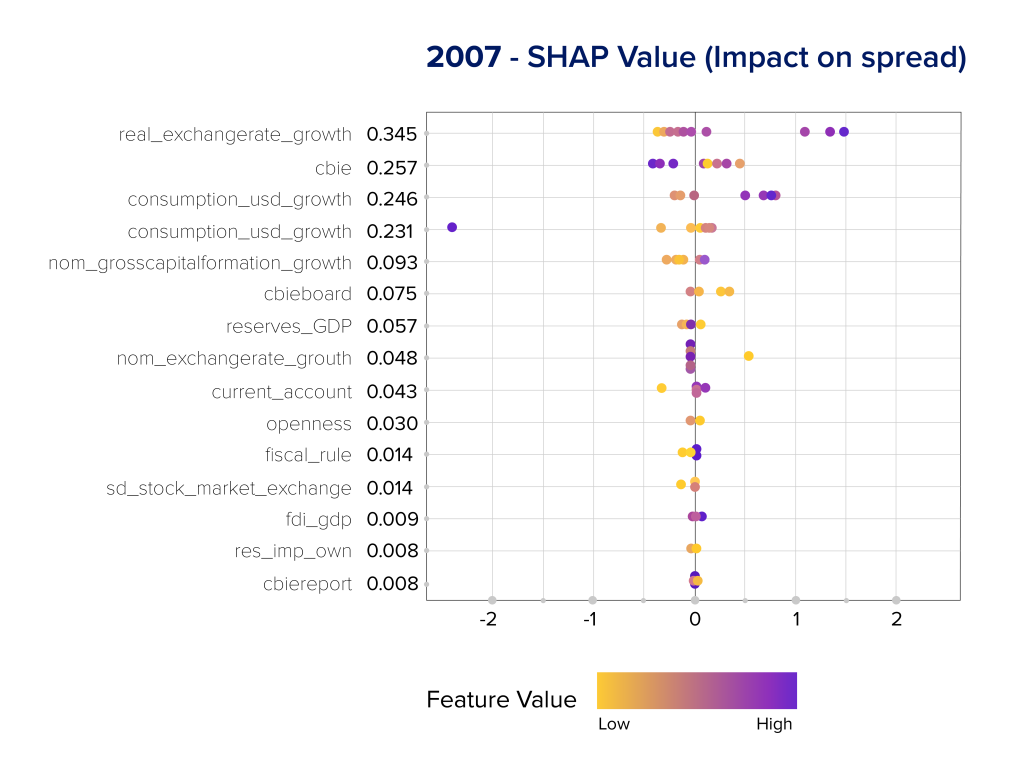

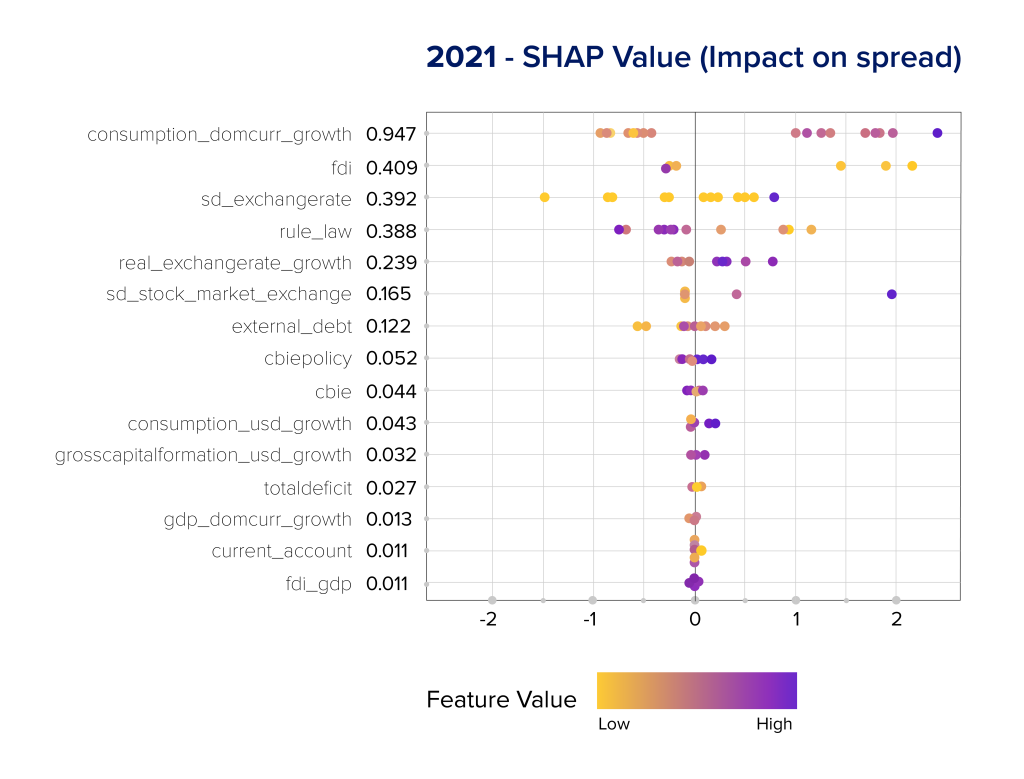

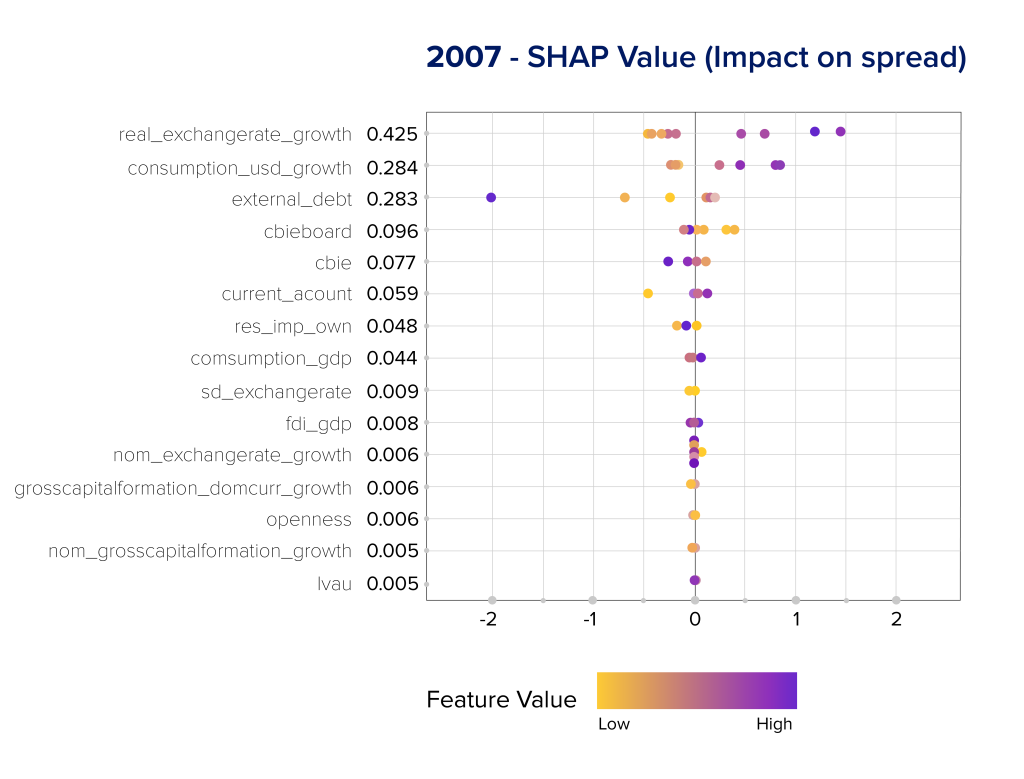

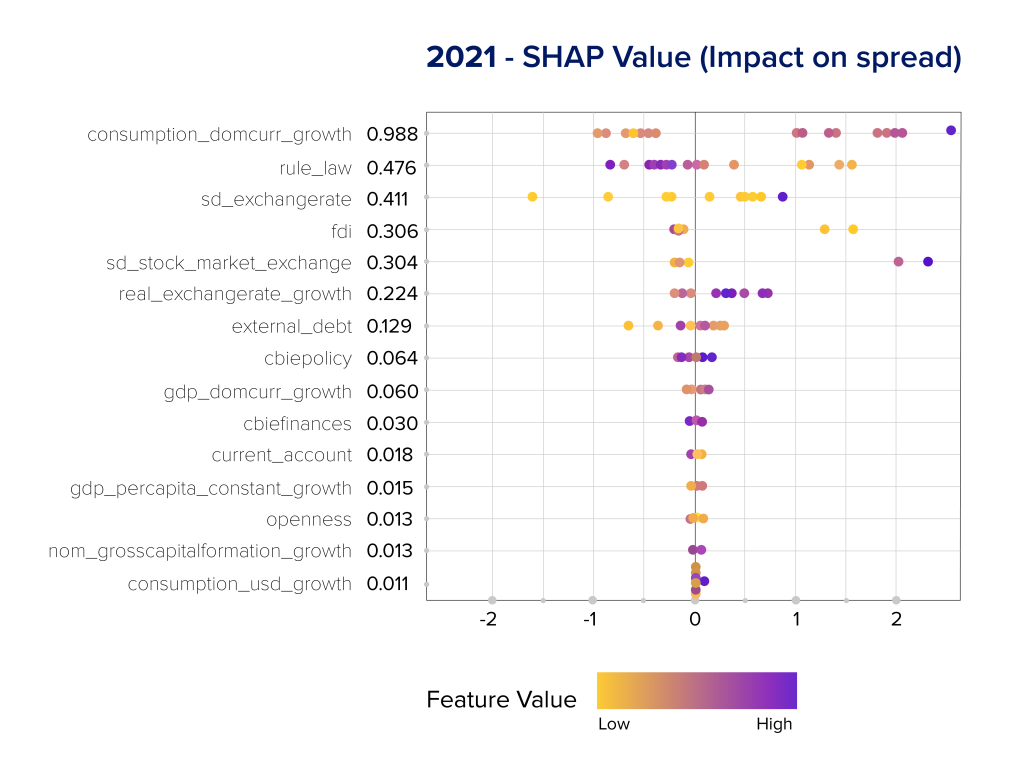

In our recent study, “An Explained Extreme Gradient Boosting Approach for Identifying the Time-Varying Determinants of Sovereign Risk”, to be published as FLAR working paper in the coming days, we study the determinants of sovereign risk (5 and 10 years), measured by government-bond yield spreads, using Extreme Gradient Boosting (XGBoots) [1]. This Methodology allows considering a large set of explanatory variables, alongside unspecified nonlinearities in the estimated effects. To interpret the results of our models, we use SHAP Additive Explanations (Shap-Values) [2]. SHAP values are one of the most popular tools in computer science to conduct Explainable Artificial Intelligence. This technique enables the identification of factors that determine a country’s risk related to its liquidity (i.e. 5 years) and solvency (i.e. 10 years), while also monitoring changes in the impact of these factors over time. This includes comparing normal years to crisis years.

Our framework includes a considerably larger set of variables than the previous literature. Selected covariates reflect the governments’ debt situation, the state of the economy including external sector variables, international reserves, and institutional variables, including the rule of law and indexes of central bank independence.

Our findings reveal that the relative effect of the various variables included in the model undergoes changes throughout the study period from 2002 to 2021. While only a limited number of variables emerge as consistent determinants across the entire period, they align with conventional indicators of sovereign risk. These variables are the current account, openness, output growth, foreign direct investment, and external debt.

Our results show that the variables that explain the behavior of sovereign risk are relatively stable over time and similar for the liquidity (5-year spread) and solvency (10-year spread) components. Among the most relevant variables are several macroeconomic fundamentals, such as the current account, GDP growth and per capita GDP growth, and the real exchange rate. International reserves and institutional variables such as central bank independence and the rule of law are also found to be relevant.

Both, in the case of the 5-year and 10-year yield, before the GFC, macroeconomic variables were the most important, especially the current account (See Figure 1 on the left-hand side for an example). However, the relative importance of these variables decreased after the GFC, giving way to institutional variables, especially the rule of law (See Figure 1 on the right-hand side for an example). This effect is more pronounced in long-term spreads than in short-term spreads.

Figure 1: SHAP values for 15 main determinants of 5-year and 10-year yield spreads (some examples)

Source: Own elaboration

Interestingly, the importance of international reserves, which played a substantial role in determining sovereign risk during the initial years of the sample, diminishes following the GFC. This outcome can be attributed to a couple of factors. Firstly, there has been a notable trend in the international monetary landscape characterized by a substantial increase in international reserves held by central banks of emerging economies. Notably, China has contributed significantly to the accumulation of reserves among emerging economies, although other countries have also played significant roles. As a result, the international reserves of emerging economies have surged from less than $500 billion in the mid-1990s to nearly $10 trillion in 2022.

Second, in response to the GFC, major central banks worldwide implemented quantitative easing measures that significantly augmented global liquidity. Although these central banks have made efforts to taper these policies in recent years, many, particularly the Federal Reserve, have maintained an accommodative monetary stance, thus sustaining elevated levels of global liquidity. The ample liquidity in international financial markets has facilitated governments’ access to abundant financing, even amidst the Covid-19 pandemic. As a result, the importance of international reserves appears to have diminished. In the same sense, their importance could increase in expectation of a reduction in US dollar global liquidity.

Interestingly, institutional variables like the rule of law and an index of central bank independence are also relevant during most of the sample period. Moreover, their relative importance has increased over the last decade. This may be since social unrest has lately risen, adding to risks for the global economy, according to the Reported Social Unrest Index calculated by the IMF (Barrett, 2022).

Our paper introduces a fresh perspective to the topic by utilizing a unique technique that leverages the latest advancements in artificial intelligence. This technique helps in discovering new connections between the various indicators of sovereign risk and their evolution in different economic global and domestic scenarios. Keep an eye out for the full study, which is scheduled to be published next week on the FLAR website.

References

[1] Chen, T. and Guestrin, C. (2016) XGBoost: A Scalable Tree Boosting System, 22nd SIGKDD Conference on Knowledge Discovery and Data Mining, 2016, https://arxiv.org/abs/1603. 02754.

[2] Lundberg, S. M., and Lee, S.-I. (2017). A Unified Approach to Interpreting Model Predictions. In Proceedings of the 31st International Conference on Neural Information Processing Systems (NIPS’17) (pp. 4765–4774). Curran Associates Inc.