Authors:

Camilo Contreras, Senior economist – ccontreras@flar.net

Carlos Giraldo, Chief economist – FLAR – cgiraldo@flar.net

Iader Giraldo, Principal economic researcher – FLAR – igiraldo@flar.net

Andrés Valqui, Professional economist – dvalqui@flar.net

Liz Villegas, Professional economist – lvillegas@flar.net

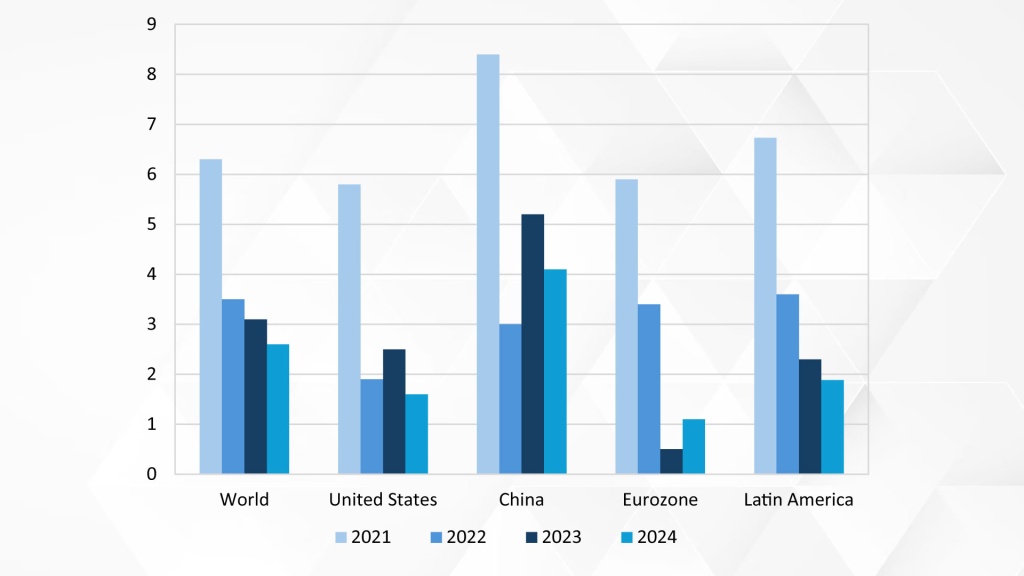

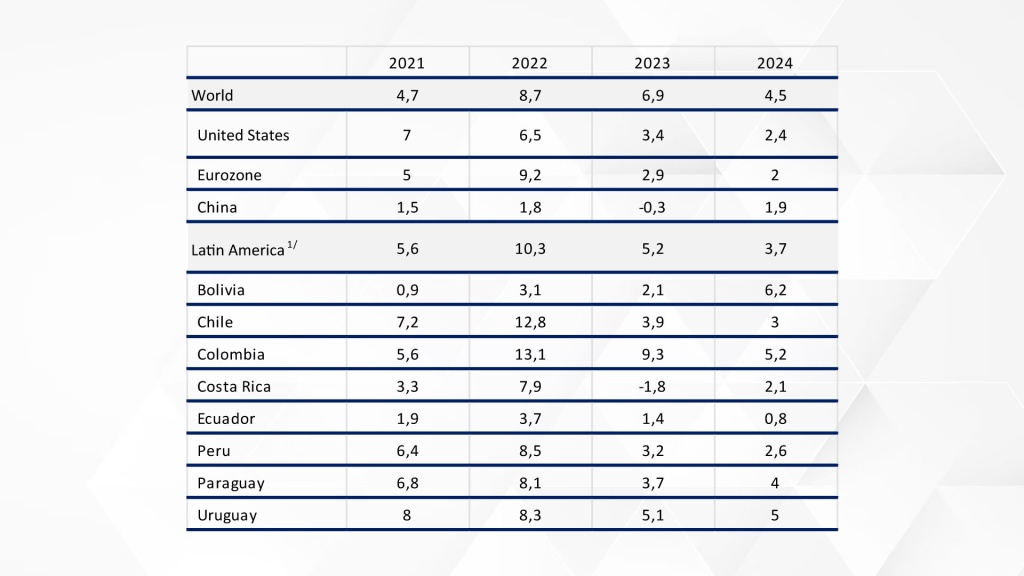

In 2023, the international context was characterized by lower economic growth than in the previous year (Graph 1) in an environment of higher global interest rates. Consumer inflation remained above its target despite declines in most of the world’s economies (Chart 2). As a result, the monetary policy rates of major central banks, including the United States Federal Reserve (Fed) and the European Central Bank (ECB), increased throughout the year. Despite this and the temporary stress in some banking systems, in addition to geopolitical conflicts and high debt levels, global financial markets performed positively.

In this context, Latin America reported lower economic growth than in 2022 (Graph 1). This was explained by a combination of external and internal factors that manifested at different intensities depending on the economy. On the external side, the region faced lower financing flows, lower demand for exported goods, especially raw materials, and lower prices for these products. On the domestic side, monetary policy was restrictive to confront inflationary pressures, while fiscal policy had limited space for countercyclical action.

Graph 1:

World GDP Growth United States, Eurozone, China and Latin America1/

(Annual % Change)

Graph 2:

Consumer Inflation in the World, United States, Eurozone, China and Latin America1/

(%, End of Period)

1/ Latin America includes Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Paraguay, Peru, and Uruguay. It is calculated using PPP GDP weights.

Source: Own estimates based on information from central banks and statistical institutes in the region.

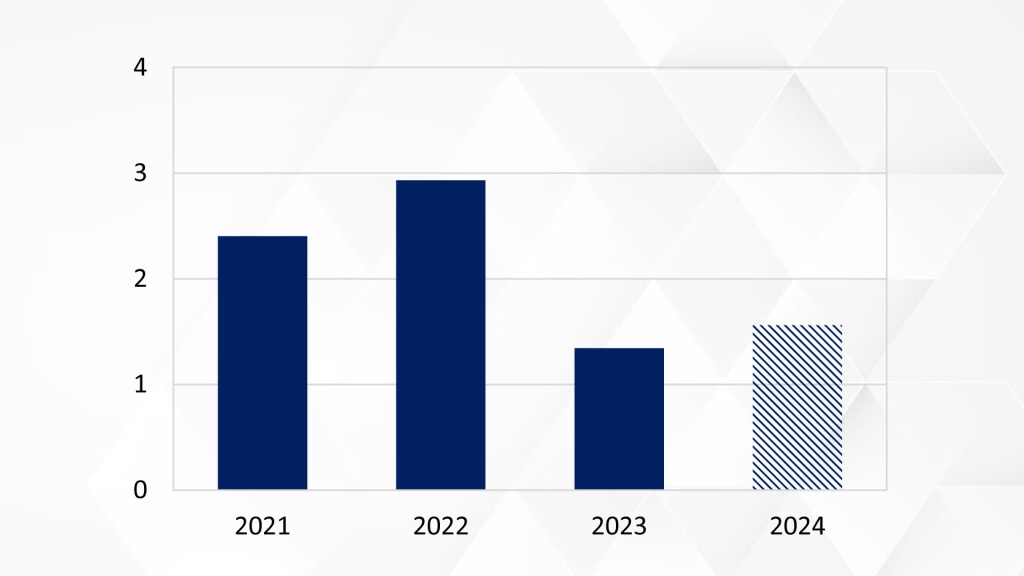

The current account deficit as a percentage of GDP decreased in most economies despite the lower dynamism of goods exports (Graph 3). This was mainly due to the decline in import growth, accompanied by the slowdown in domestic absorption , in the context of higher international and local interest rates. The lower deficit reduced the region’s external vulnerability to possible stops or sudden reversals in capital flows.

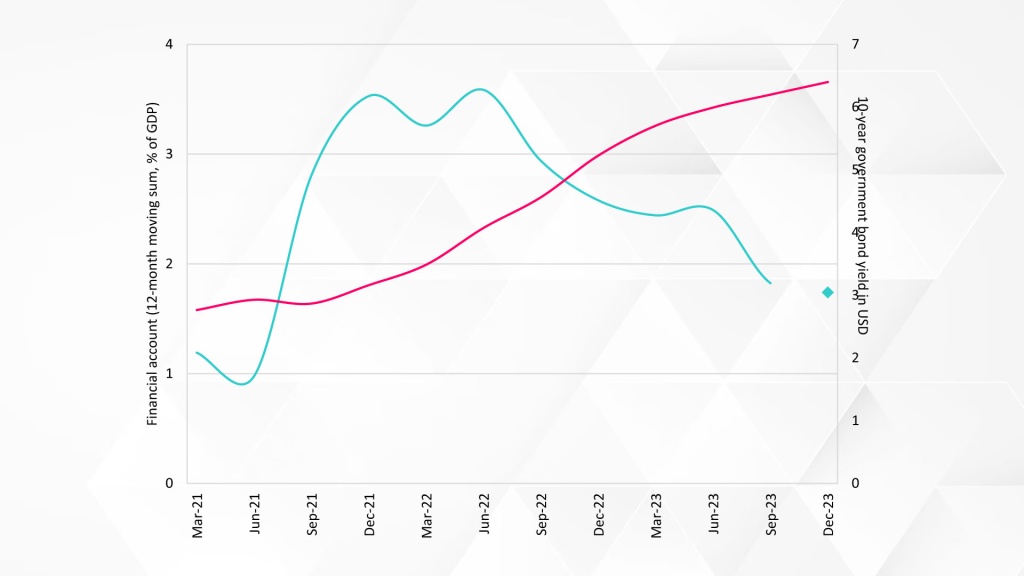

In contrast, external financing flows decreased throughout the year, according to preliminary figures from the financial and capital accounts of the balance of payments (Graph 4). This emerged in connection with the narrowing of international financial markets.

Graph 3:

Current Account Deficit in Latin America1/

(% of GDP)

Graph 4:

Financial Account of the Balance of Payments1/ and 10-Year Bond Yield Rate2/

(%)

1/ Latin America includes Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Paraguay, Peru, and Uruguay. Grouped by PPP GDP. December 2023 is an estimate.

2/ Simple average of bonds from Brazil, Chile, Colombia, Mexico, and Peru.

Source: Central banks of the region – FLAR-DEE calculations.

Given the heterogeneity of the exchange regimes and external conditions of the region’s economies, central banks’ international reserves exhibited mixed behavior (Graph 5). The central banks of Brazil, Chile, Colombia, Costa Rica, Mexico, Paraguay, and Uruguay posted increases; of particular note is the case of the BCCR, which had an increase of more than 50% during the year.

Consumer inflation fell but remained above the target level of most central banks. This led to monetary policy interest rates remaining at high levels despite the start of reductions by most of the regional monetary authorities. The central banks of Costa Rica and Uruguay led the decisions for the first cuts in monetary policy rates, while others such as that in Mexico kept their reference interest rates unchanged.

Graph 5:

Net International Reserves of Central Banks

(Millions of USD)

Source: Central banks of the region.

In connection with the lower economic dynamism and high external and local interest rates, credit growth to the private sector decreased in most economies. However, the main aggregate indicators of the banking system did not show warning signs despite the deterioration of portfolio quality in several countries.

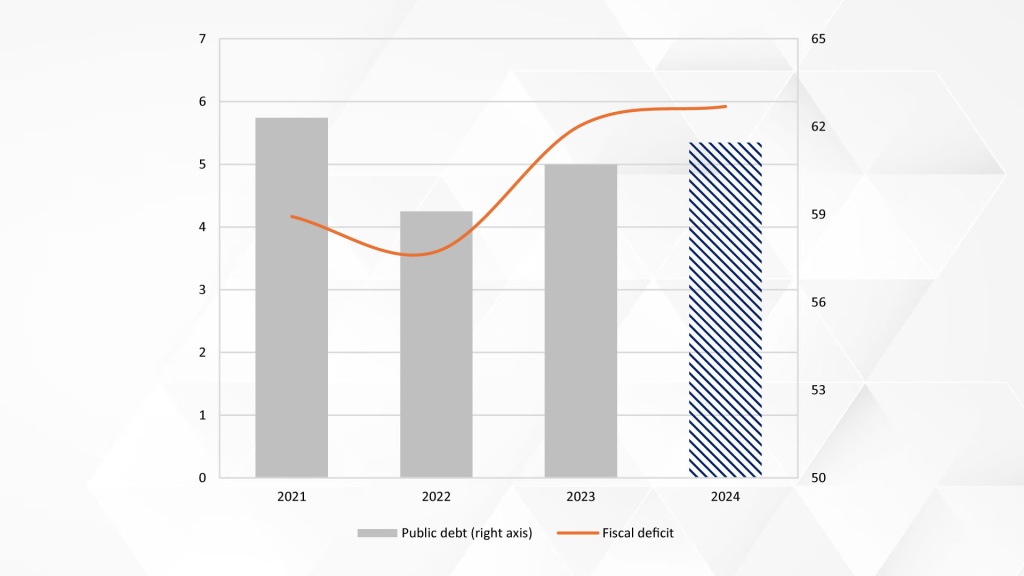

For their part, fiscal deficits increased (Graph 6). Preliminary estimates indicate that the average fiscal deficit as a percentage of GDP increased to 5.6% in 2023 from 3.6% in 2022. On the one hand, revenues were affected by lower economic activity and the lower prices of raw materials exported by several countries. On the other hand, expenses were pressured by higher interest payments on public debt.

Graph 6: Deficit and Debt in Latin America 1/ (% del GDP)

1/ Considering Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Paraguay, Peru, and Uruguay. Grouped by PPP GDP.

Source: Central banks of the region and ministries – FLAR-DEE calculations.

Public debt experienced a minor increase relative to that presented in fiscal deficits, explained in part by the effect of the exchange rate appreciation on the valuation of the external debt that occurred in several economies throughout the year. In this sense, it is estimated that public debt as a percentage of GDP ended the year at 60.7%, compared to 59.1% at the end of the previous year.

Lower global growth is expected for 2024, although within a soft-landing scenario for the United States and the Eurozone, while consumer inflation will continue to decrease. In this context, the Fed and the ECB are expected to begin their interest rate reduction cycle toward the second half of the year. Similarly, the external demand and prices of the region’s main exported products are expected to remain close to those observed in 2023.

In connection with the above, the region’s economic growth will be lower than that of 2023, led by the lower growth of Brazil3 and Mexico and the continued low growth of the Colombian economy. In this framework, a decrease in inflation rates is projected, which would continue to gradually converge to their target levels. The current account deficit is expected to remain at levels close to those observed in 2023 (approximately 2% of GDP).

Fiscal accounts are expected to exhibit mixed behavior, marked by spending pressures due to high-interest payments and more significant budgetary needs due to the impact of natural phenomena. With the above, debt as a percentage of GDP is expected to increase.

In this environment, various risks persist for macroeconomic and financial stability this year. These include a longer-than-expected delay in the convergence of inflation to its target levels, perhaps due to the emergence of new inflationary shocks. Difficulties may also arise in the fiscal adjustment processes in various countries in the context of high interest rates. This may be linked to episodes of political and social instability. In this sense, authorities are challenged to preserve the resilience that has characterized the region in recent years.

- Latin America here encompasses Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Paraguay, Peru and Uruguay, which represent approximately 80% of the GDP of Latin America and the Caribbean.

- Household and government consumption and investment.

- On the supply side, lower growth in the agricultural sector is expected due to less favorable harvest forecasts, as well as lower growth in extractive industries. On the demand side, lower growth in private consumption and moderate growth in exports are expected after a positively atypical year in this area.