Authors:

María Alejandra Amado – Economist – Department of International Economics and Euro Area, Bank of Spain.

Iader Giraldo – Lead economics researcher at Latin American Reserve Fund (FLAR).

The 1990s saw the beginning of a significant expansion of Spanish banking in Latin America. Today, the strategic character of the region among the leading Spanish multinational banks is crucial, as is Spanish banking in the financial systems of the largest economies in Latin America. On December 13, 2021, the Deputy Governor of the Bank of Spain, Margarita Delgado; the Senior Director of Financial Services at Standard & Poors, Cynthia Cohen; and the Lead Economist for Financial Systems at BBVA Research, Olga Gouveia, presented their views on the state of and perspectives on the Spanish banking system in Latin America. The panelists presented their analysis from the perspectives of the regulator, risk rating agencies, and private banks in a webinar jointly organized by the Bank of Spain and the Latin American Reserve Fund (FLAR, 2021), whose messages can be summarized in the following lines.

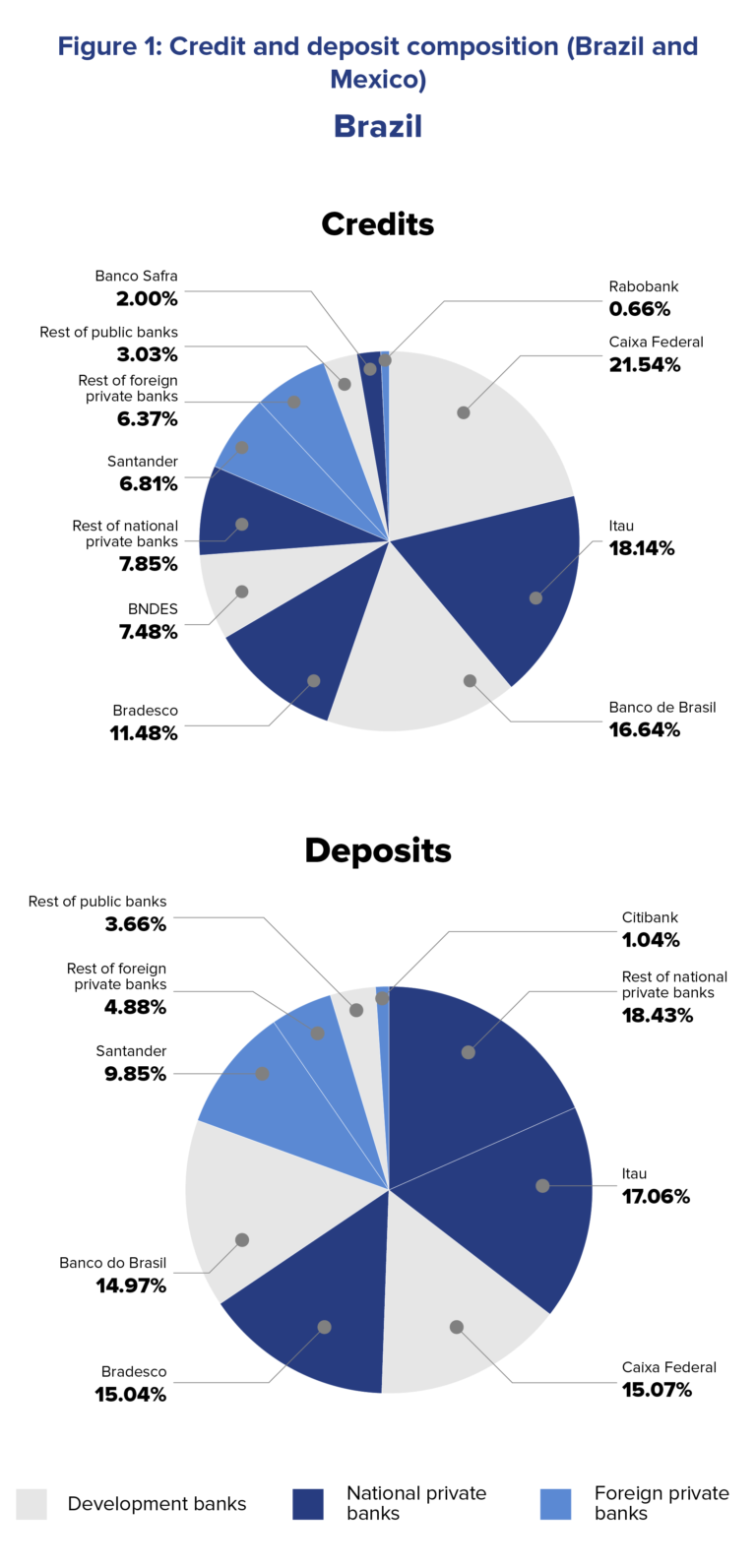

Banco Santander and BBVA have taken the lead in the region, ranking among the five most important financial institutions in Brazil, Chile, Colombia, Mexico, and Peru. In the case of Brazil, Banco Santander is the leading foreign-owned bank in terms of market share. Meanwhile, BBVA maintains a leading position in Mexico even above local banks (see Figure 1).

Spanish banking is relevant for the region, but Latin American banking activity is also an essential component of the balance sheets and profits obtained by multinational banking groups. As of June 2021, the assets from the banking activity of the BBVA and Santander groups in Latin America represented 16% of their consolidated balance sheet total and approximately 28% of their assets abroad. Likewise, the profits received by these entities from Mexico and Brazil represented 21% and 16% of their total profits, respectively1.

A significant part of the benefits of Spanish banking participation in Latin America has been a consequence of the international expansion model chosen, known as the decentralized multinational model. It has been based on the acquisition of local banks set up as independent subsidiaries with their own governance and boards of directors. The major benefit of this model lies in gains in geographic diversification of both assets and liabilities, smoothing the effects of economic turbulence that may affect both the parent company and its subsidiaries. However, the international expansion of Spanish banks under this model poses substantial risks, one of which is exposure to exchange rate volatility, which affects the value of the profits obtained by the group.

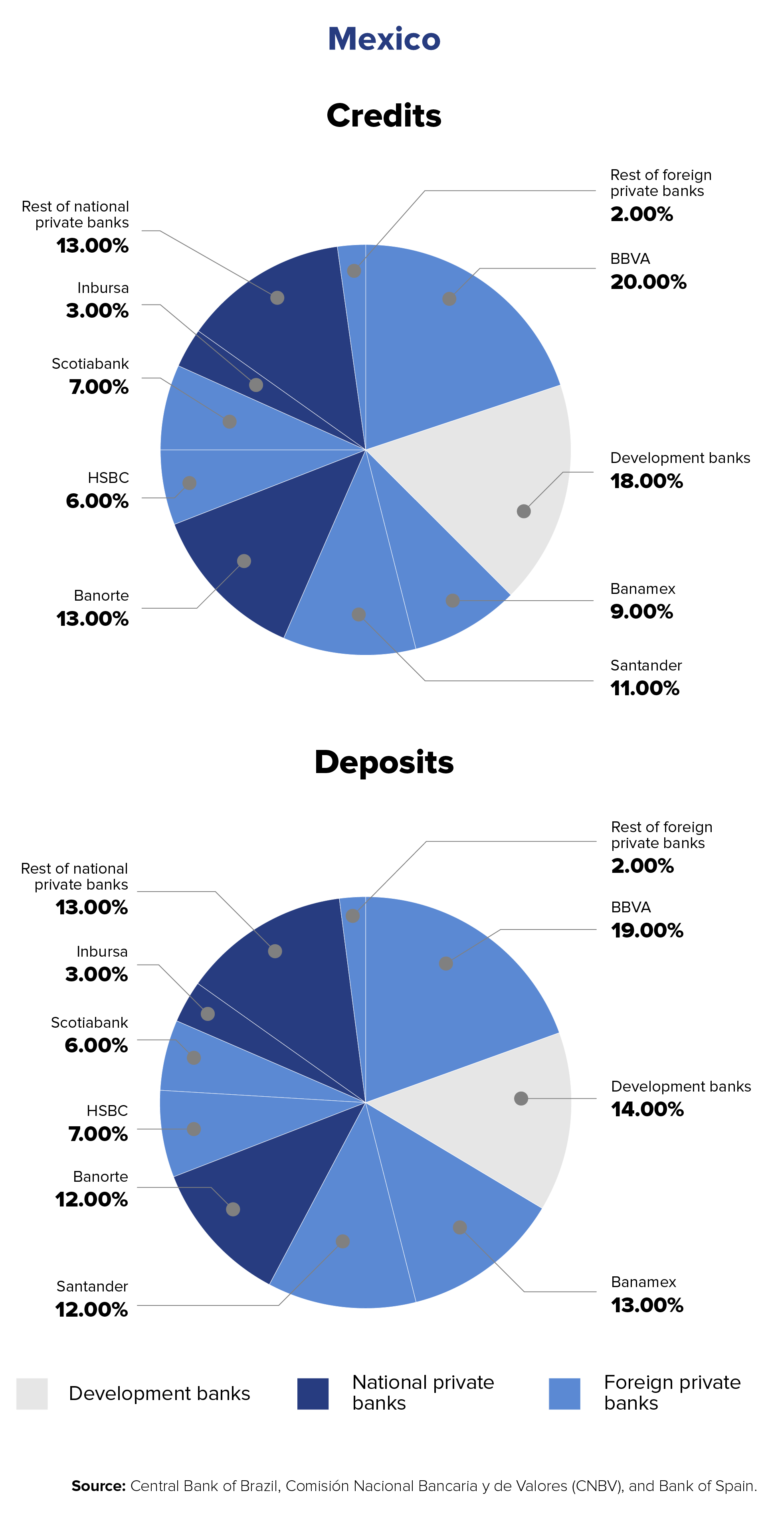

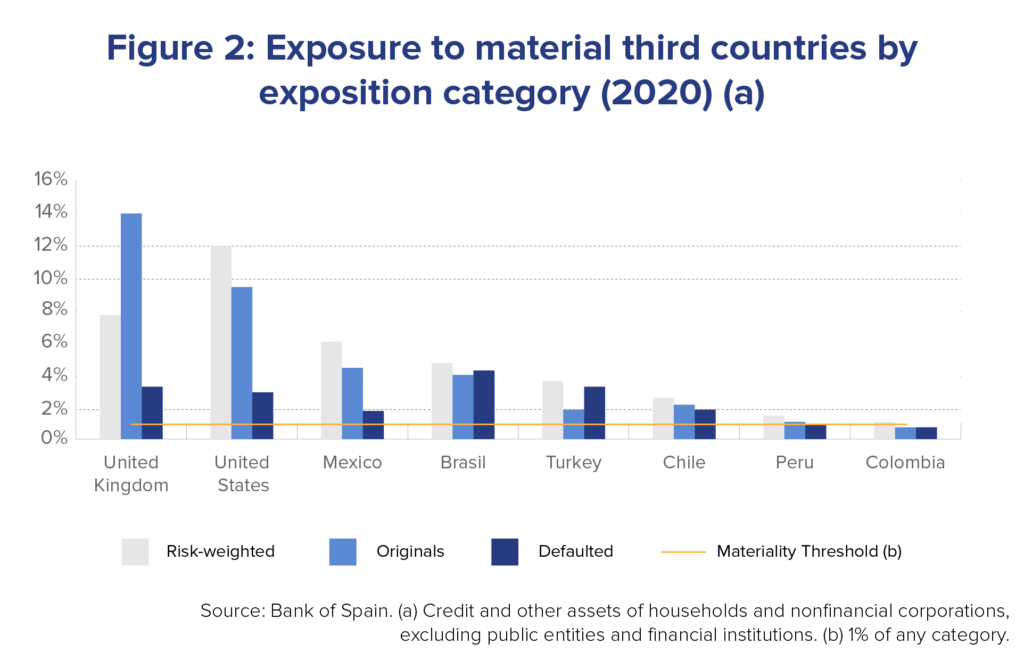

The Bank of Spain periodically performs an exercise to identify potentially risky countries for the Spanish banking system for the purposes of the countercyclical capital buffer (CCB).2 For this purpose, the volume of international exposures of Spanish banks is analyzed following the methodological guidelines of the European Systemic Risk Board (ESRB). It defines a 1% threshold for three categories of exposures: original, risk-weighted and defaulted. Countries exceeding this threshold in any category are defined as material third countries. In 2021, the ERSB identified eight material countries, five of which are in Latin America (Brazil, Mexico, Chile, Colombia, and Peru). Indeed, exposures to Latin America accounted for a quarter of total banking exposures outside Spain, including the European Union, at the end of 2020. (See Figure 2).

The current diagnosis shows how Latin American banks entered the pandemic-generated crisis with conservative growth relative to their historical levels. This was due to the region’s moderate growth over the last five years, political volatility, and, therefore, lower investor confidence. Nevertheless, the banks faced the crisis effectively with government support, low levels of leverage, and little external funding, which was to a large extent facilitated by their experience in dealing with highly volatile contexts. Thus, bank profitability fell during the crisis but remained above global averages without reaching negative values.

The COVID-19 crisis has been a global shock that, in a way, has allowed us to evaluate the role of regulatory and prudential measures adopted by different countries in the region to limit contagion to the international financial system. Despite the well-known adverse effects of the pandemic on the region’s growth, the banking sector has remained strong throughout the crisis, in contrast to previous episodes of global crises that usually resulted in banking crises. Part of this resilience is due to a series of timely measures taken to support the financial system by the proper authorities – central banks, regulators, and supervisors. These measures include the establishment of secured credit lines, the easing of funding conditions, and temporary prudential regulatory measures such as the limitation of dividends or the temporary reduction of capital requirements.

The future outlook for banks in Latin America is quite encouraging. From the partial control of the pandemic in most countries and the surprising economic recovery in 2021, the banking system’s profitability is expected to gradually improve. This will be driven mainly by a more significant role of consumer credit and the positive effects on banking activity of an upward cycle of interest rates that has been occurring in the region. However, there may be a deterioration in agents’ payment capacity after the withdrawal of government aid, although thus far, the effects have not been very significant in the countries that have eliminated this aid.

Given the implications of the connection between the Spanish and Latin American financial systems, the Bank of Spain, the entity in charge of ensuring the financial stability of the Spanish banking system, considers it crucial to monitor the economic and geopolitical environment in Latin America. Likewise, as a regional financial agreement and active link in the global financial safety net, the Latin American Reserve Fund permanently monitors the economies of the region and their interrelations through the international financial system, as in this particular case, with the Spanish banking system. The current diagnosis of the Latin American banking system and of Spanish banks in particular is positive, serving as an example of how Latin America has shown remarkable strength in the face of adverse external conditions arising from the pandemic. However, many challenges must be promptly addressed by the economic and political authorities of the different countries in the region.

References

FLAR (December 14th, 2021) FLAR TALKS. “Situation and perspectives for the Spanish banking system in Latin America”