Authors:

Iader Giraldo – Lead researcher at Latin American Reserve Fund (FLAR).

Autor: Philip Turner – University of Basel and former Deputy Head of MED at Bank for International Settlements (BIS).

A decade of exceptionally low long-term interest rates, reinforced by renewed monetary policy easing in the advanced economies after the COVID-19 shock, has encouraged global investors to seek the higher yields offered by emerging market dollar bonds. And investors have been further enticed by the development of bond funds which offer the liquidity of a daily price even when the underlying securities are illiquid.

The share of bank loans in international credit has dropped appreciably since the Global Financial Crisis (GFC) – partly because new international regulations clamped down on banks but left bond market intermediation virtually unscathed (Turner, 2021).

Larger dollar debts and the heavier reliance on international bond markets have created new risks for non-financial corporations (NFC) in Latin America.

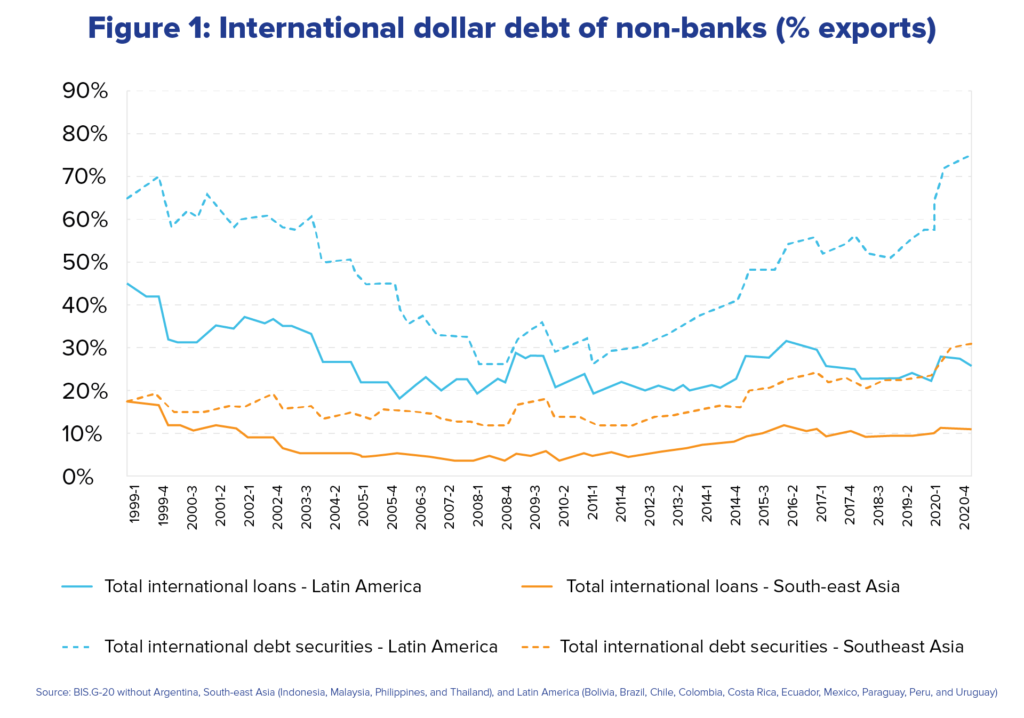

Figure 1 shows that the shift to international bond markets has been especially marked in Latin America. The dollar bonds outstanding of non-banks in Latin America had risen from 30% of exports in 2010 to 60% of exports by 2019. Then, after the pandemic, bond debts jumped to almost 80% of exports. But dollar international bank loans rose only slightly: 21% of total exports in 2010 to 24% by 2019 and were still around this figure after the pandemic. In Southeast Asia, by contrast, dollar international bank loans and debt securities grew at similar rates.

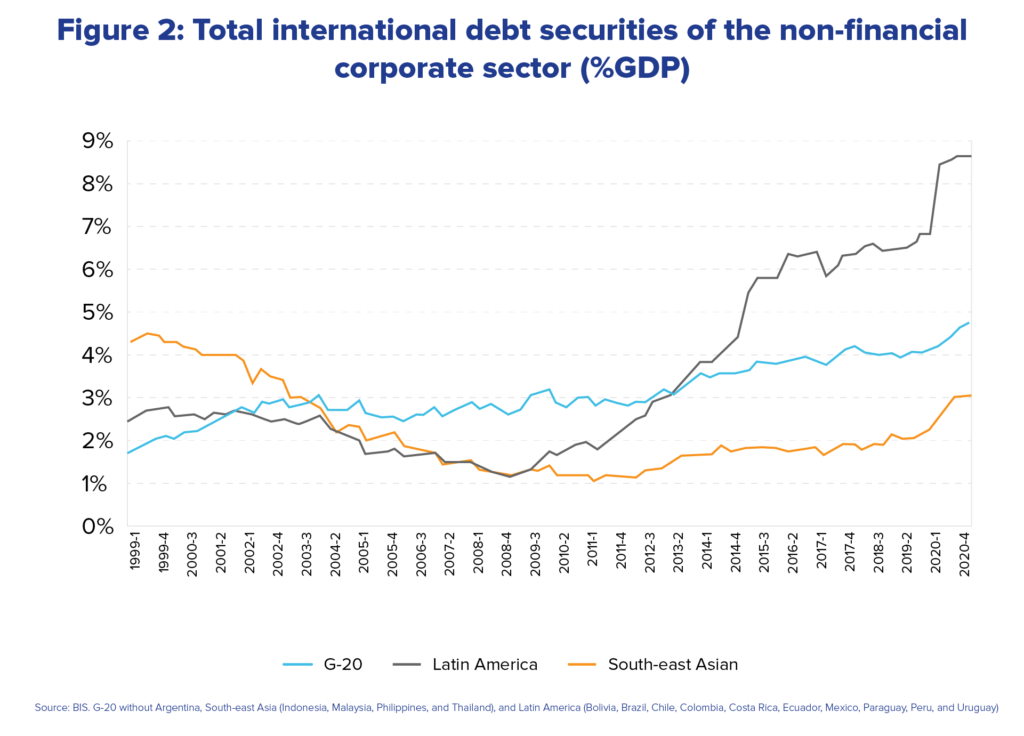

International bond debts of the NFC sector in Latin America have risen substantially since the Global Financial Crisis. It has become the main funding channel of companies and reducing the role of bank credit. Figure 2 shows Latin America in the global context of international debt securities (amounts outstanding). The growth of NFC international debt has been greater in Latin America than in other countries. For 2019, international debt securities of NFC in Latin America, as a percent of GDP, were three times the figure in the Southeast Asia region and 1.5 times the ones in G-20 countries. It is also clear in the graph how the pandemic shock raised the Latin American NFC debt by around 2% of GDP – much more than in the other countries. But note also that G20 NFC debt was beginning to rise strongly from 2019 – which is relevant for any assessment of the current risks.

The dollar is still the dominant foreign currency, accounting for over 80% of international debt securities of NFC in Latin America. In terms of total exports, the NFC sector’s total dollar international debt securities in Latin America rose to 30% of exports in 2019, jumping to 37% of exports in 2020 after the Covid-19 shock. Again, this figure is above that in either Southeast Asia or in G-20 countries, where exports provide a larger natural hedge to exchange rate shocks than in the FLAR+4 countries.

Calculations of the corporate sector’s net foreign currency liability position (i.e., including foreign currency assets) has also increased sharply. Hence currency mismatches, which had fallen in the years before the GFC, have risen over the past decade or so. The concentration of currency exposures in the private sector (the official sector holding large stocks of dollar assets) tends to destabilize the exchange rate as firms with dollar debts rush to hedge their exposures whenever expectations change. A preliminary investigation of company-level data suggests the high leverage and marked currency mismatches tend to go together in the more vulnerable companies whose debt service costs are high relative to profits.

The mix of increased leverage, greater currency mismatches and (often) lower profits has made many companies in FLAR+4 countries more vulnerable to changes in the international financial environment. This could become a source of risk in Latin America as a whole. There are at least three potential implications for financial stability.

The first is that many companies have become more fragile – surviving only when interest rates are very low and credit abundant. The second is that some firms have become much bigger players in the domestic financial system. Very favorable international financing conditions have encouraged companies to borrow more than needed for their core businesses. Often excess funds have been placed with local banks or invested in domestic securities. Higher interest rates at home are a strong temptation. Not only does this increase the financial risk exposures of these firms but it also means that non-financial corporate stress is more likely to spill over to local banks and markets. Third, foreign exchange hedging markets in many Latin American currencies are comparatively thin. Companies will often hedge long-term dollar debt with 3-month swaps. In periods of stress, however, the terms of such hedges typically turn against firms which are short dollars. Some markets even disappear. These elements underline the importance of this recent phenomenon in the financial and macroeconomic stability of Latin America.

At present, the highest near-term risk is perhaps of an unexpectedly sharp rise in yields in international benchmark bond markets. Strong recent and prospective increases in private and public dollar debt issuance point in this direction. So does the increase in inflation risk premia in dollar bond markets. Even more dangerous would be a premature normalization of monetary policy in the United States and other advanced economies (FLAR, 2021). It could generate much turbulence in the region, lifting risk premia, cutting corporate profits, and lowering the market value of companies. Under such circumstances, the authorities should be prepared to respond. And they need to prepare now to ensure that financial systems are robust enough to resist periods of heightened market stress.

[*] The opinions contained in this document are the authors’ sole responsibility and do not commit FLAR or its directory board. FLAR+4 countries are the FLAR member countries (Bolivia, Colombia, Costa Rica, Ecuador, Paraguay, Peru, Uruguay, and Venezuela) plus the four greatest non-member countries (Argentina, Brazil, Chile, and Mexico), representing 95% of Latin America GDP. Throughout this article, we use «FLAR+4» and «Latin America» interchangeably.

References

FLAR. (May 27th, 2021). FLAR TALKS.»Motivations and effects of the U.S. Federal Reserve´s liquidity lines during the current crisis«

Turner, Philip (2021): “A new monetary policy revolution: advice and dissent” NIESR Occasional Paper no 60. February.