Authors:

Carlos Giraldo, Latin American Reserve Fund, Bogotá, Colombia. Email: – cgiraldo@flar.net

Iader Giraldo, Latin American Reserve Fund, Bogotá, Colombia. Email: – igiraldo@flar.net

Mauricio Losada-Otálora, Associate profesor, Pontificia Universidad Javeriana, Bogotá, Colombia. Email: – mauricio.losada@javeriana.edu.co

Nathalie Peña-García, Full professor, Colegio de Estudios Superiores de Administración – CESA, Bogotá, Colombia. Email: – nathalie.pena@cesa.edu.co

The financial landscape in Latin America is undergoing a transformative shift with the growing adoption of Fast Payment Systems (FPS). These systems, which facilitate real-time or near-real-time financial transactions 24/7, offer numerous advantages over traditional payment methods, such as cash and cards. With features like low transaction costs, accessibility, and immediate availability of funds, FPS is poised to revolutionize how payments are conducted. However, their adoption across the region is influenced by various factors, including financial literacy and deeply entrenched beliefs about cash.

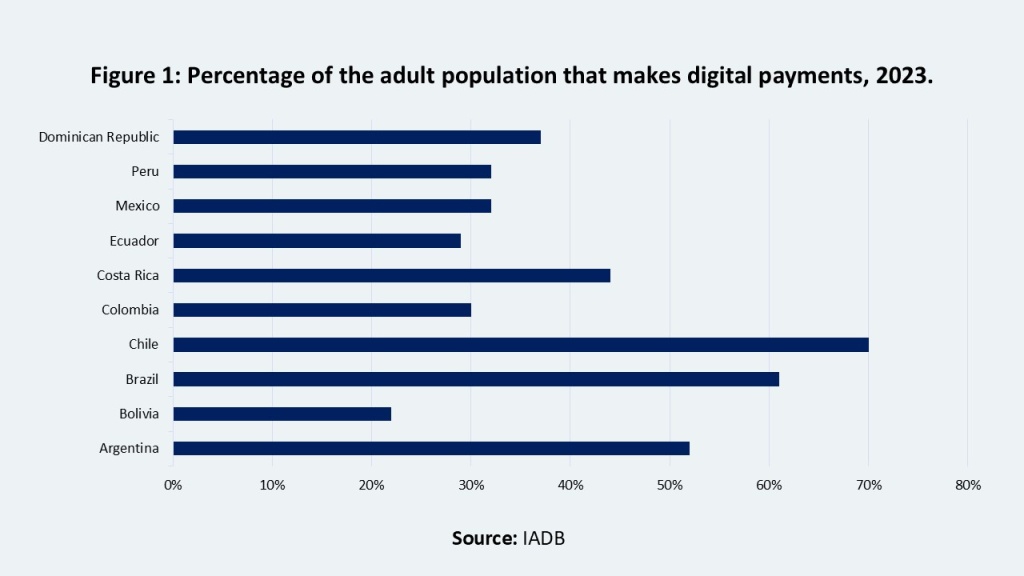

Digital payments have been gaining traction globally, with an anticipated market transaction value of $11.55 trillion in 2024, growing to $16.62 trillion by 2028, Statista (2024b). In Latin America, digital payment revenues are expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2022 to 2027, driven by the rise of e-commerce and the increasing digitization of businesses (Figure 1). Central banks in the region have also played a pivotal role by introducing innovative payment systems to enhance financial inclusion and foster competition among financial service providers.

FPS is one such innovation that provides an alternative to traditional methods by offering faster, cheaper, and more secure transactions. Countries like Argentina, Mexico, and Brazil have already seen significant penetration of FPS, with 49%, 39%, and 28% of their total digital transactions conducted through these systems, respectively, Iorio et. al. (2024)

Our recent research “The adoption of Fast Payment Systems (FPS): The role of financial literacy and cash-related beliefs” highlights financial literacy as a critical determinant of FPS adoption. Financial literacy endows individuals with the knowledge, skills, and confidence to navigate the complexities of modern financial systems. In Latin America, individuals with higher levels of financial literacy are more likely to adopt FPS, as they can better understand its benefits compared to traditional methods like cash. This knowledge reduces uncertainties and increases trust in innovative payment systems, paving the way for greater acceptance.

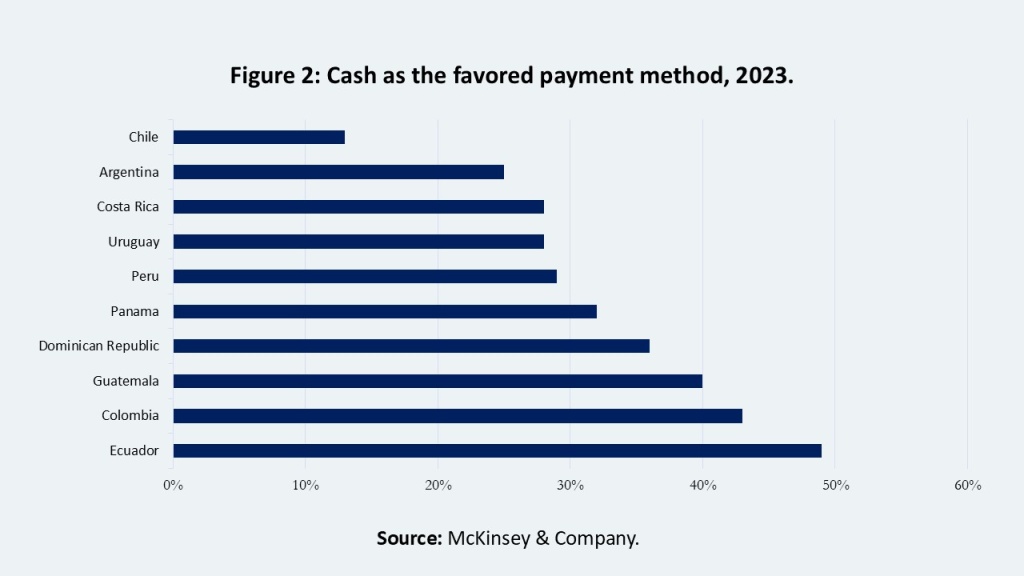

Despite the advantages of FPS, cash remains a deeply established payment method in many Latin American countries (Figure 2). Positive beliefs about cash—such as its convenience, familiarity, and universal acceptance—pose a significant barrier to adopting FPS. For many, cash is seen as a tangible and straightforward option that requires no additional learning or infrastructure. These beliefs can undermine the perceived usefulness and ease of use of FPS, reducing individuals’ willingness to adopt new systems.

To gain a comprehensive understanding of the dynamics surrounding the adoption of financial payment systems (FPS), our research expands upon the Technology Acceptance Model (TAM) by incorporating two critical external factors: financial literacy and beliefs about cash. Our findings reveal that individuals with higher financial literacy tend to recognize the limitations of cash, such as security risks and the practical inconveniences of handling physical currency. This awareness can lead to a decline in positive beliefs about cash and foster a greater openness to alternative payment solutions. In contrast, preconceived notions about cash can negatively influence perceptions of FPS, causing some individuals to underestimate their usefulness and ease of use, which can create barriers to adoption.

Moreover, we discovered that positive attitudes towards FPS are significantly shaped by perceptions of their practicality and simplicity. When individuals come to see FPS as convenient and secure alternatives to cash, they are more likely to express a strong intention to adopt these systems. Thus, our research highlights the intricate relationship between financial literacy, beliefs about cash, and the acceptance of financial payment systems. By addressing these factors, monetary authorities can develop more effective strategies to promote the adoption of FPS, ultimately enhancing the efficiency and security of financial transactions.

For FPS to achieve widespread adoption, addressing the cognitive and practical barriers posed by cash is essential. One effective strategy is to improve financial literacy by drawing on user experiences; governments and financial institutions should prioritize financial education initiatives to help individuals understand the limitations of cash and the benefits of FPS. This could involve workshops, digital resources, and gamified learning experiences. Additionally, a user-centric design is crucial. Developers of FPS platforms must focus on creating intuitive and user-friendly interfaces to reduce the perceived complexity of these systems. Simple onboarding processes and clear instructions can make FPS more accessible to first-time users.

Targeted marketing campaigns can also play a significant role. By utilizing comparative advertising that highlights the advantages of FPS over cash—such as enhanced security, convenience, and hygiene—consumer perceptions can be reshaped. Engaging visuals and customer testimonials can further build trust in these systems. Finally, implementing trial programs can encourage adoption; offering free trials or incentives for first-time users can help individuals experience the benefits of FPS firsthand, effectively reducing resistance to using these platforms.

In conclusion, the adoption of Financial Payment Systems (FPS) holds immense promise for enhancing financial inclusion across Latin America. By offering a seamless, cost-effective, and accessible payment solution, FPS can empower underserved populations, helping them access essential financial services and improving their overall economic opportunities and quality of life.

However, realizing this vision will require a united effort among policymakers, financial institutions, and technology providers. It’s crucial to address both the cognitive and structural barriers that hinder adoption. By promoting financial literacy and challenging long-held beliefs about cash, we can unlock the true potential of FPS, paving the way for a more inclusive financial future in the region.

References

Iorio, A. D., Kosse, A., & Szemere, R. (2024). Tap, click and pay: How digital payments seize the day. https://www.bis.org/statistics/payment_stats/commentary2402.htm

Statista. (2024b). Digital Payments—Worldwide | Statista Market Forecast. Statista. https://www-statista-com.cvirtual.cesa.edu.co/outlook/dmo/fintech/digitalpayments/worldwide