Authors:

Carlos Giraldo – Latin American Reserve Fund | FLAR

Iader Giraldo – Latin American Reserve Fund | FLAR

Jose E. Gomez-Gonzalez – Lehman College, City University of New York; and, Visiting Professor (Summer School), Universidad de La Sabana.

Jorge M. Uribe – Universitat Oberta de Catalunya

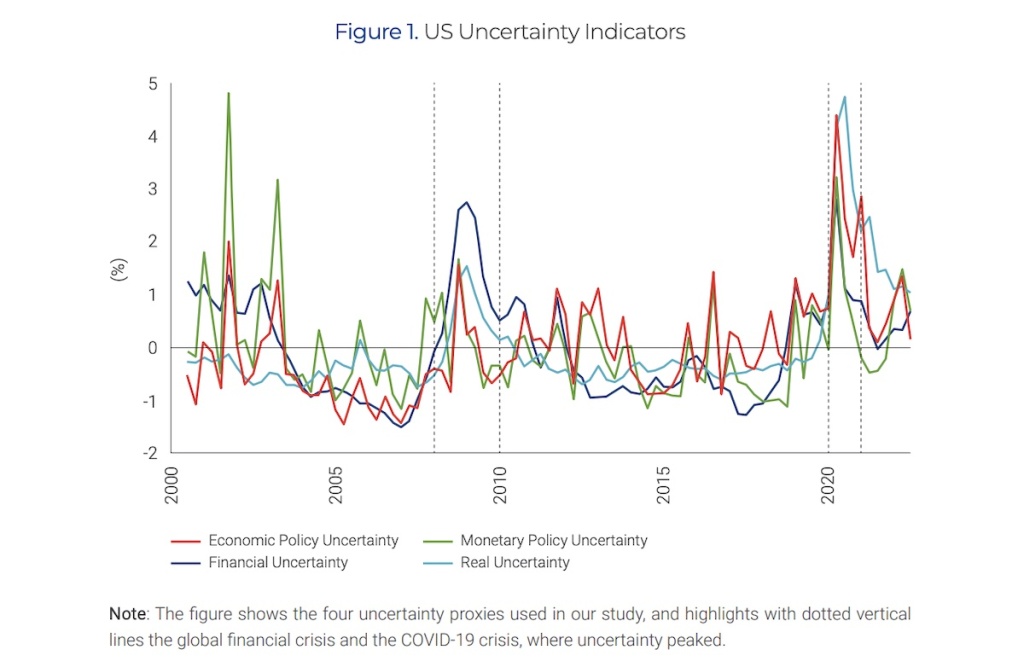

The world’s economies are currently experiencing heightened levels of uncertainty, with a notable contribution from the United States (US), as depicted in Figure 1. This uncertainty has had significant impacts on various markets and economies. Examples of recent financial events include Silicon Valley Bank and First Republic Bank, the uncertainty surrounding the FED’s monetary policy decisions, and the approval of the debt ceiling by the US legislative, which has persisted over the last few years.

The effect of aggregate uncertainty on real and financial markets has recently attracted a great deal of attention in academic and policy circles. The economics literature has examined the impact of US’ uncertainty shocks on developed and large emerging market economies. However, this research has not accounted for global cycles in production, credit, and prices, which can influence the estimates of the effects of US uncertainty on the rest of the world. More effort is also necessary to better understand the propagation of US uncertainty shocks to other countries, especially to emerging market economies.

Research in this direction is relevant for at least two reasons. First, uncertainty exerts considerable influence on credit dynamics and, therefore, on the dynamics of investment and economic activity in general. During booms, as banks are optimistic about the ability of firms to repay their debt, they tend to lower their creditworthiness standards and extend more loans. The opposite happens during economic downturns. In fact, credit crunches occur during periods of extreme pessimism with respect to future economic performance (Wisniewski and Lambe, 2013; Mehrotra and Sergeyev, 2021). Constraints for lending are generally not created by deposit shortages but by the unwillingness of banks to lend in moments of high uncertainty. Uncertainty can therefore play a major role in shaping financial and economic outcomes.

Second, as emphasized by Bhattarai et al. (2020), policy makers in emerging market economies (EMEs) often attribute both downward revisions of their economic forecasts and increased volatility in international capital flows to increases in US uncertainty. In fact, fluctuations in US uncertainty can have significant policy implications for EMEs beyond the direct negative spillover effects they generate. The effects may drive the global financial cycle similarly to the way in which the Federal Reserve’s monetary policy does.

Arguably, Latin America has been the most crisis-prone region in the world in the face of international shocks over the past decades, as illustrated by the balance-of-payment crisis in the 1980s and several banking crises in the 1990s (Canova, 2005; Garcia-Herrero, 2021). Latin America is a highly indebted and heterogeneous region that is particularly sensitive to US economic and financial conditions, particularly uncertainty, in its various dimensions: real, financial, and policy related (including monetary policy). However, countries in the region are highly heterogeneous from institutional, macroeconomic, and financial perspectives. Therefore, a better understanding of the transmission of a varied range of US shocks to several LACs contributes to the international finance literature dealing with spillovers, contagion, and international shock transmission.

In our recent paper “US uncertainty shocks, credit, production, and prices: The case of fourteen Latin American countries”, we analyze the effects of uncertainty shocks on 14 Latin American countries (LACs) of various sizes and various levels of dependence on US financial and real flows. They are: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Peru, Paraguay, and Uruguay, a highly heterogeneous group of countries according to their degree of financial openness, with varying degrees of commercial and financial dependence on the US (including dollarization), and with different institutional frameworks.

The countries in our dataset are analyzed here for the first time along the four dimensions of US uncertainty that we propose (i.e., economic policy, monetary policy, macrofinancial, and real uncertainty). Unlike previous studies that do include emerging market economies (e.g., Bhattarai et al., 2020; Rivolta and Trecroci, 2020; Belke and Osowski, 2019), we focus on the role of credit markets in the transmission of uncertainty, and we also consider the distinct (but complementary) roles of real, financial, and economic policy uncertainty (including monetary policy uncertainty). Another distinctive feature of our work is that we explicitly consider the global factors that drive credit, production, and price cycles around the world and that might “contaminate” the effect of US uncertainty shocks on the rest of the world, as estimated in the previous literature.

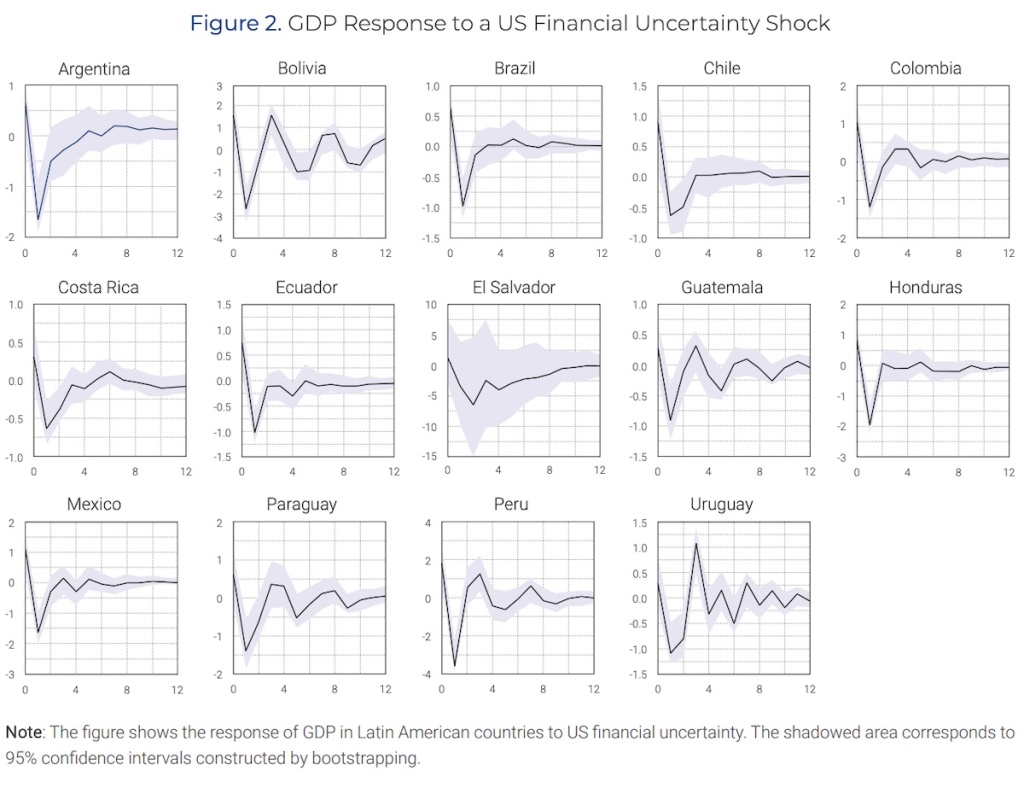

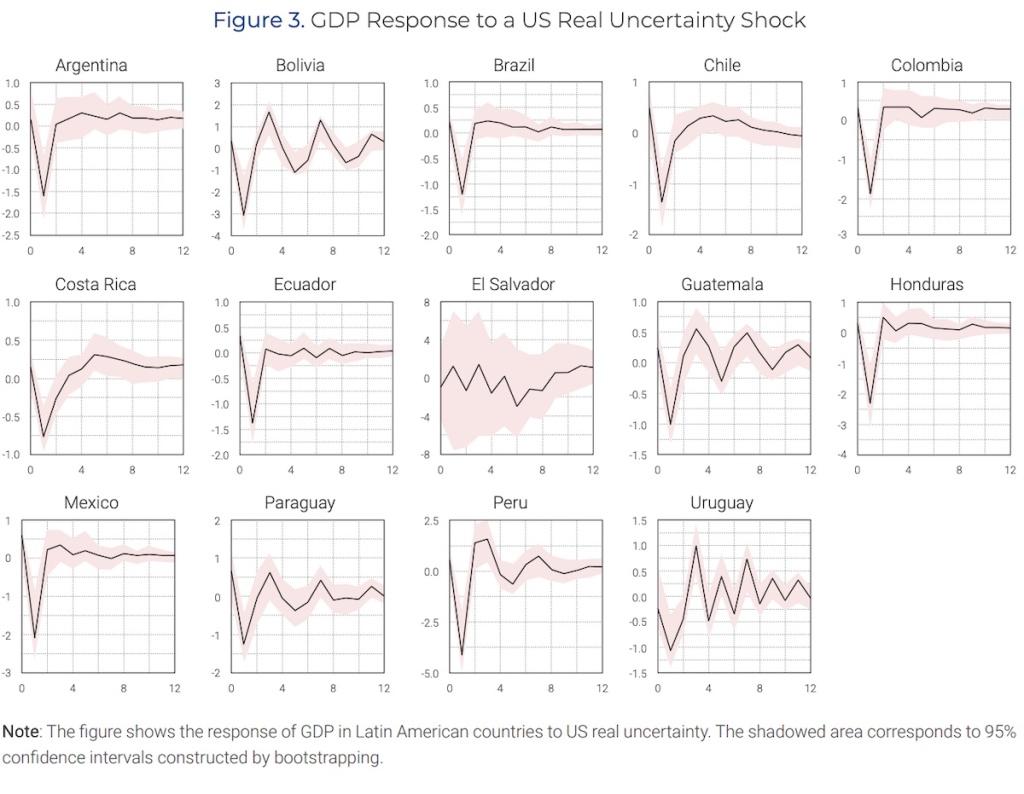

Our main findings indicate that the responses of credit, GDP, and prices in LACs countries to US uncertainty shocks are highly heterogeneous, depending on the country and the specific type of shock. Responses are not easily clustered according to country characteristics. For instance, responses do not systematically depend on country size, level of financial development, level of connectedness with the US economy, degree of dollarization, or subregion within LACs.

Our results also show that the effects of real and financial uncertainty are more significant and long-lasting than those of economic and monetary policy uncertainty (Figures 2 and 3). All forms of uncertainty have a larger and more persistent impact on the gross domestic product of countries than the impact on credit and prices. Output in the majority of countries responds negatively and significantly. This result indicates that policy implementation and the design of portfolio diversification strategies, when faced with US uncertainty shocks, merit research efforts at the national level.

Additionally, the duration of the credit response tends to be shorter than the duration of the output response. This fact implies that the transmission of US uncertainty shocks to Latin America seems to be explained more by trade and investment channels than by financial channels. This can be explained by the fact that financial markets in LACs are not well developed, and their degree of integration with US financial markets is relatively low.

Our research indicates that uncertainty in the United States has varied impacts on the output, credit, and prices in 14 Latin American countries. Given the current global economic situation, particularly with post-pandemic adjustments, significant uncertainty in the U.S. is expected to persist for some time. As a result, emerging economies, particularly those in Latin America, will continue to be affected. It is crucial for policymakers in Latin America to focus on identifying transmission channels and implementing measures to safeguard the region’s financial and macroeconomic stability.