Authors:

Iader Giraldo – Lead researcher at Latin American Reserve Fund (FLAR).

Philip Turner – University of Basel, Visitor at NIESR (London) and former Deputy Head of MED at Bank for International Settlements (BIS).

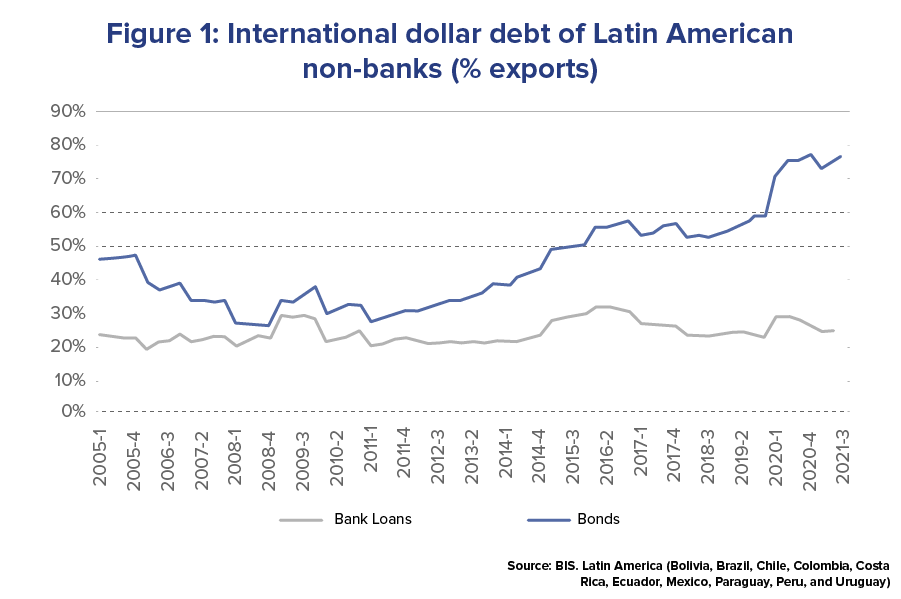

Low long-term interest rates in the dollar after the Global Financial Crisis (GFC) and failings in the regulatory oversight of international bond markets have led investors to take more and more risk in their search for higher yields. Non-financial corporations (NFCs) in Latin America have taken full advantage of such favorable conditions. One indicator of this is that the international bond debt of Latin American non-banks has, measured against exports, more than doubled in the past decade (see figure 1).

Our recent research (Giraldo and Turner (2022)), with the same title as this blog post, uses data from 160 Latin American companies to document the many warning signs of macroeconomic and financial instability in the region from such indebtedness.

Six clear warning signs are identified:

- Currency mismatches of non-financial corporations have increased.

- The corporate sector has become more leveraged. For firms in the tradable sector, higher leverage and increased dollar borrowing tend to move together.

- Greater leverage has not enhanced the return on equity. Despite significant depreciation in the real effective exchange rates, profitability has declined in the tradable sector.

- Capital expenditure has been cut.

- The narrowing in credit risk premia across companies in the face of a sizable increase in the leverage of the most-indebted companies suggests credit risks are being underpriced.

- Even as global interest rates fell, interest payments took a larger share of profits. The increased interest burden of the weakest firms is a particular concern.

With profitability declining and debt increasing, the traditional indicators of rising solvency risk are flashing red. The debt-at risk-indicator for the tradable sector has risen sharply in the past decade. When interest rates were still low and liquidity abundant, this indicator suggested that 33% of debt in 2019 was at risk, rising to 40% in 2020. Although the continuing impact of COVID-19 and sharp rises in commodity prices make it hard to assess the current situation, this indicator warrants monitoring.

A bright spot for Latin American companies is that near-term dollar liquidity pressures have been eased as long-term bond finance has significantly displaced short-term (or floating rate) bank loans. They are now less vulnerable to sudden reversals of external finance. Their borrowing costs depend less on the Fed funds rate and more on the yield on long-term US government bonds. Access to longer-term finance is an unquestionable benefit as it gives companies and the authorities more time to prepare for adverse shocks.

The economic authorities should not delay too long in monitoring this situation. Dollar interest rates will rise. New international rules for non-bank financial institutions and bond market practices are under discussion. This is likely to increase the credit and liquidity spreads cost of bond issuance by smaller companies whose bonds are in any case illiquid.

Such a scenario would make it all the more important for the authorities in borrowing countries to develop macroprudential rules for non-financial companies borrowing dollars in international capital markets. Bank regulators in Latin America already have in place extensive macroprudential rules for currency mismatches in banks (Tobal (2014)). And measures to curb the foreign currency exposures of banks have helped to constrain the build-up of non-financial corporate leverage (IMF (2021)). But tougher rules on banks in the major financial centers have actually pushed risks into capital markets (Cizel et al (2016)). The lack of regulatory tools directed specifically at non-bank financial institutions is a major policy gap.

What needs to be done? Greater transparency is one suggestion. An almost perennial recommendation is that the public disclosure of corporate currency mismatch risks of emerging markets economies’ non-financial companies needs to be improved.1 Yet even the simplest statistical building blocks are still missing. The breakdowns of a company’s liabilities and financial assets into those denominated in foreign currency and those in domestic currency are not generally available. Nor do we know the exports/home sales split of its gross revenues.

Secondly, more light is also needed on the greater role of companies in financial intermediation. Much more needs to be known about the destination of financial resources raised in global bond markets. Finally, the size and nature of their business dealings with domestic banks (as wholesale depositors, as beneficiaries of credit lines, as counterparties for derivative contracts and so on) could change quickly when conditions deteriorate in global financial markets.

This global financial environment is changing in two big ways. The monetary policy shift has been well advertised. Markets are aware that dollar interest rates are going to increase, but no one knows how much. A regulatory shift that is also coming gets less attention. The authorities in the main financial centers know that the current prudential oversight of nonbank financial institutions and capital market practices are, to quote the head of the BIS, not “fully fit for purpose”. How and when the rules will be tightened remains to be seen.

The statistical evidence marshalled in the paper, imperfect as it is, is strong enough for everybody involved (companies, creditors, credit rating agencies and the authorities) to take a hard look at non-financial corporations in Latin America with large dollar debts and ask: what happens when monetary and regulatory policy action in the United States tightens financial conditions in dollar bond markets?

[*] The opinions and points of view expressed are the sole responsibility of the authors, and not of FLAR or its administrative bodies.

[1] Almost twenty years ago, Goldstein and Turner (2004) noted that the international regulators argued that improved transparency was the way to handle risk oversight of private nonfinancial companies. But they also noted that this “hands-off” approach had not worked in the Asian financial crisis. In any event, audited public disclosure by companies of their currency exposures was too poor for transparency to work effectively. In addition, the lack of comparable data across companies and across countries made analysis difficult.

References

Cizel, J., Frost, J., Houben, A., and Wierts, P. (2016). Effective macroprudential policy: cross-sector substitution from price to quantity measures. IMF Working Papers. WP/16/94.

Giraldo, I., and Turner, P. (2022). The dollar debt of companies in Latin America: the warnings signs. FLAR working papers.

Goldstein, M., and Turner, P., (2004). Controlling currency mismatches in emerging markets Washington DC. Institute for International Economics.

IMF. (2021). Loose financial conditions, rising leverage and risks to macro-financial stability. Global Financial Stability Report. April

Tobal. M., (2014). Prudential regulation, currency mismatches and exchange rate regimes in Latin America and the Caribbean. CEMLA Research Paper no 17. November.