Authors:

Camilo Contreras, Senior economist – FLAR – ccontreras@flar.net

Carlos Giraldo, Chief economist – FLAR – cgiraldo@flar.net

Iader Giraldo, Principal economic researcher – FLAR – igiraldo@flar.net

Instant payments are credit transfers that make funds available in a payee’s account within seconds of a payment order being made, emulating the immediacy offered by cash. Furthermore, instant payments have minimal or zero costs, are processed 24 hours a day, and have low or no settlement risk, improving the payment experience and promoting financial inclusion for consumers and businesses (Bostic, et al., 2023).

To date, more than 60 economies around the world have implemented instant payment systems (IPSs). One of the most successful cases is that of India, whose Unified Payments Interface (UPI) was launched as a pilot in 2016. The UPI currently handles over a billion transactions monthly and, in terms of volume, has surpassed other payment methods such as checks, electronic cards, and cash (Khiaonarong & Humphrey, 2022).

In Latin America and the Caribbean, the case of Pix in Brazil is the most successful, given its rapid expansion and adoption among the Brazilian population. It has exceeded usage expectations and promoted widespread financial inclusion. As of May 2023, the Pix system had been used by more than 140 million people (approximately 80% of the adult population) and 13 million businesses, according to statistics from the Central Bank of Brazil (IMF, 2023).

Beyond the success of Pix and other significant developments, such as Mexico’s CoDi platform, progress in IPS implementation in the region is quite heterogeneous. However, there are common factors for most central banks and economic authorities in the IPS adoption process.

To gain a detailed overview of the evolution, objectives, challenges, and obstacles faced by different countries in the region in the process of adopting IPSs, the Latin American Reserve Fund (FLAR) held the Regional Instant Payments Forum in Quito, Ecuador, on October 26 and 27. The event included the participation of members from 9 central banks in the region and the Bank of Spain.

As part of this event, we conducted a brief survey of the participants to gauge the progress in IPS implementation in Latin America and the Caribbean. The results are very interesting for advancing the adoption of these systems in the region and understanding the main challenges presented. Here are some of the key takeaways from this survey:

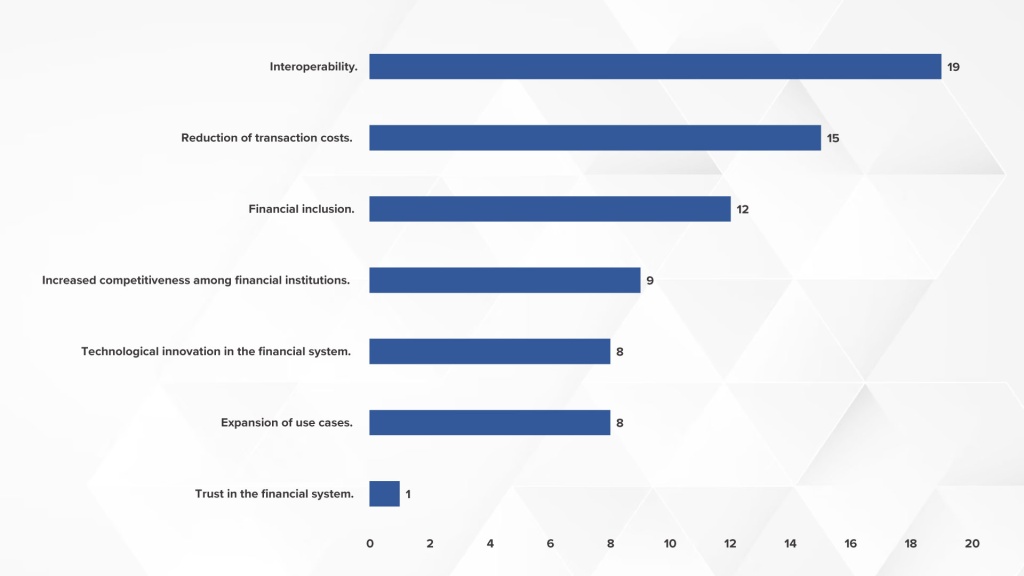

Regarding the benefits and needs that the adoption of IPSs aims to address, participants see multiple advantages and solutions to various problems currently facing payment systems. Interoperability, reduced transaction costs, and financial inclusion appeared to be the main benefits of implementing an IPS (Graph 1). Other factors, such as competition among financial institutions, technological innovation in the financial system, and the expansion of use cases, were also mentioned.

Graph 1. Main benefits of IPS implementation

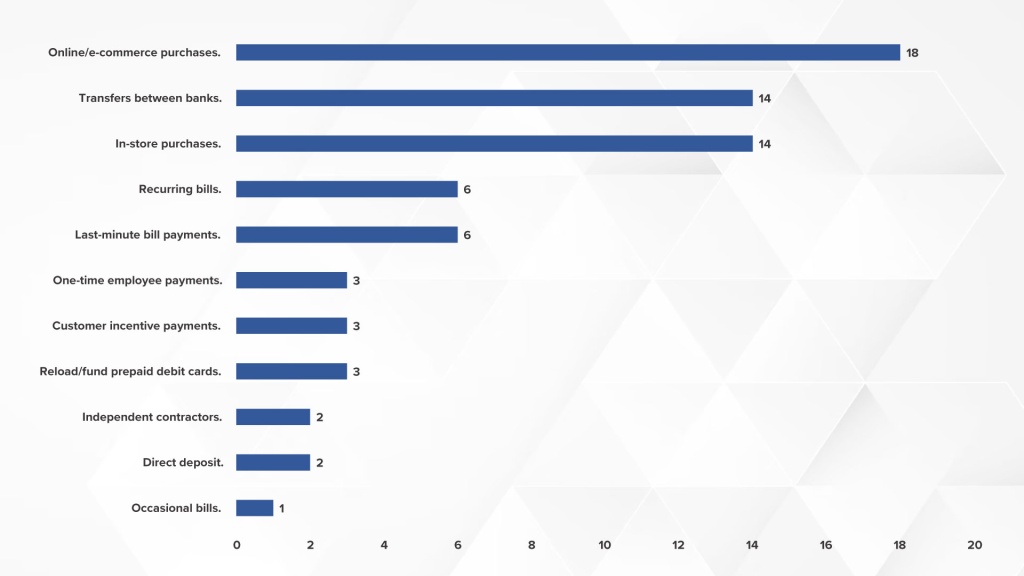

Graph 2. Expansion in use cases

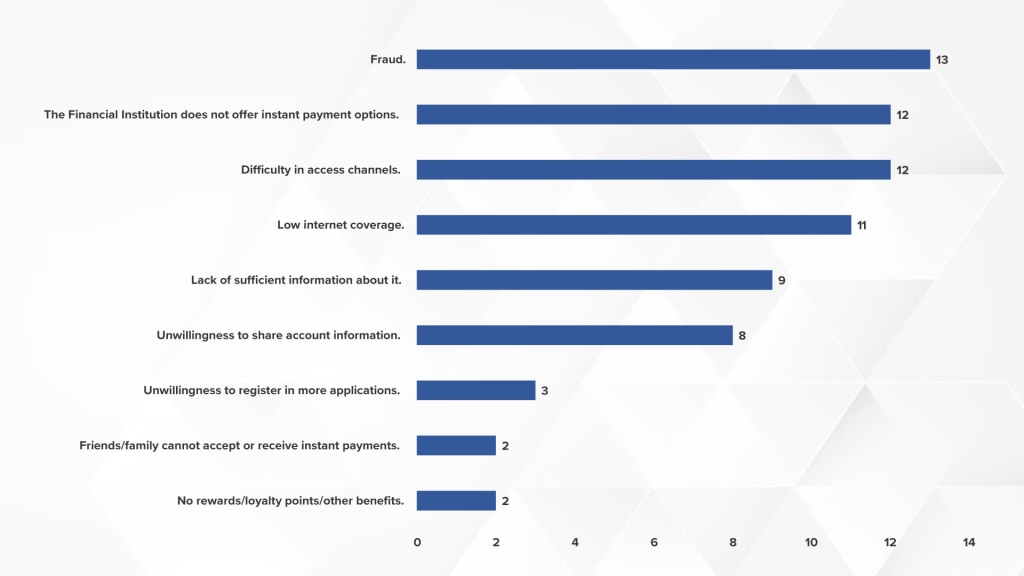

Graph 3. Main barriers to IPS implementation

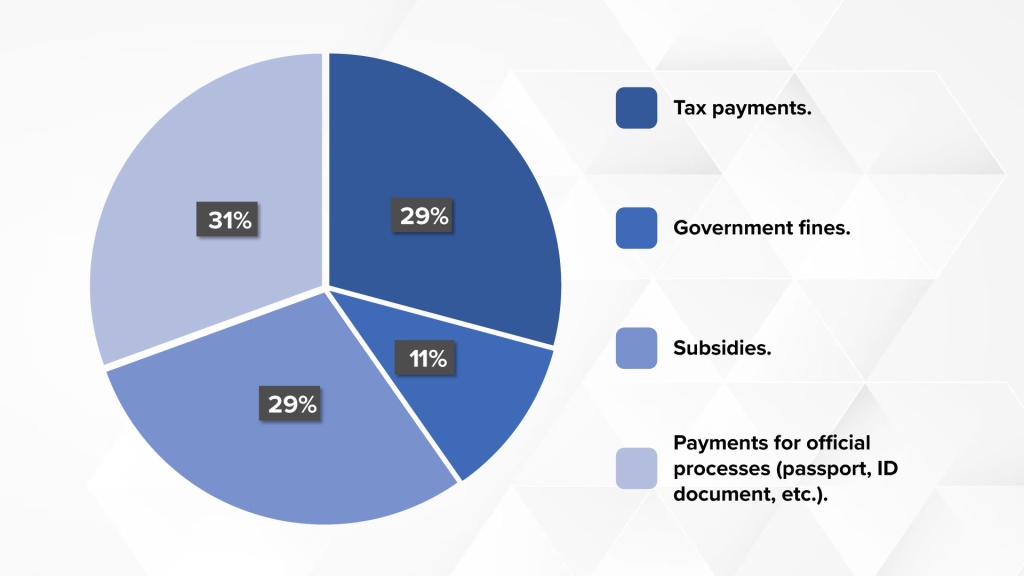

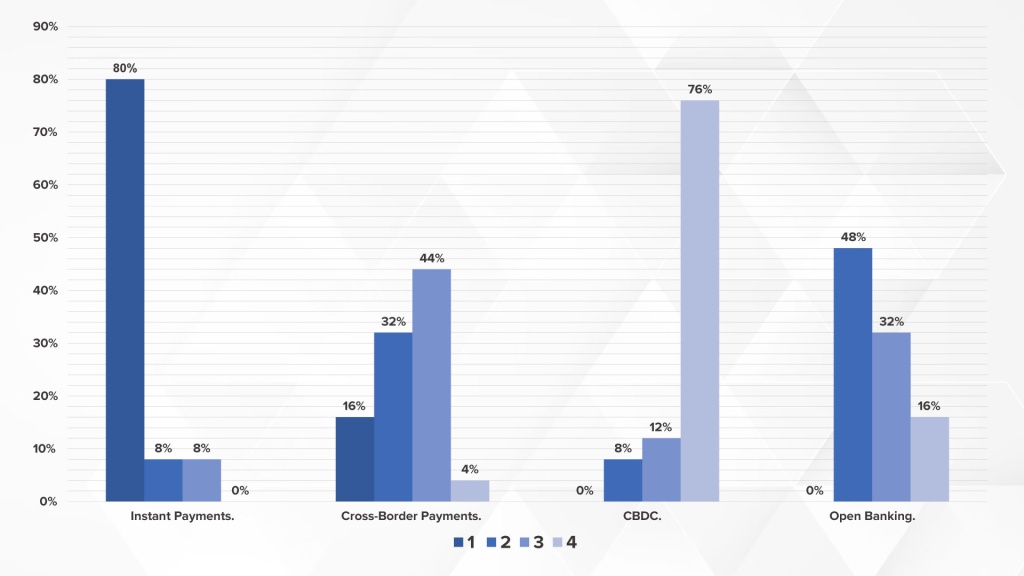

Graph 4. Implementation strategies for the digital payment ecosystem

References

- Arango, C., Ramírez, A. C., & Restrepo, M. (2022). Person-to-business Instant payments: could they work in Colombia? Borradores de Economía, 1192, Banco de la República.

- Bostic, R., Mark, G., Alcazar, J., O’Brien, S., Shaffer, L., & Washington, J. (2023). Connecting the Dots: How Adoption of Instant Payments Can Lead to a More Inclusive Economy. Federal Reserve of Atlanta.

- IMF. (2023). Pix: Brazil’s Successful Instant Payment System.

- Khiaonarong, T., & Humphrey, D. (2022). Instant Payments: Regulatory Innovation and Payment Substitution Across Countries. IMF Working Papers.