Authors:

Carlos Giraldo, Chief Economist at the Latin American Reserve Fund (FLAR)

Iader Giraldo, Principal Researcher at the Latin American Reserve Fund (FLAR)

The unprecedented global health crisis caused by the COVID-19 pandemic has greatly challenged economies worldwide. The impact of the responses to face the pandemic has led to an increased debt burden due to measures like expenditure packages., and a decrease in revenue collection due to economic slowdowns. As we navigate the post-pandemic era, it becomes crucial to restore fiscal sustainability and prepare for future shocks.

In May, we were privileged to host two events that focused on the crucial topics of public debt sustainability and fiscal challenges in a post-pandemic world. The first event was the 7th joint Regional Financing Arrangements (RFA) research seminar, which we conducted jointly with the European Stability Mechanism (ESM) and the Asean+3 Macroeconomic Research Office (AMRO) on May 25-26. The second event was a webinar we organized under our FLARtalks series on May 29 (See FLARtalks, 2023).

Our discussions were especially relevant due to the current complex situation. We are facing multiple shocks, including the effects of the pandemic, unexpected inflation increases, major central banks increasing monetary policy rates, political tensions, and even war. This has led to a high level of uncertainty, with recent events involving financial systems in the US and Europe, uncertainty surrounding the FED’s monetary policy decisions, and the US legislative branch’s approval of the debt ceiling. Overall, these factors have made policy trade-offs clearer than ever before.

Distinguished speakers honored the occasion and imparted their expertise on the subjects above. During these events, the discussions underscored the need for fiscal normalization and consolidation. This blog post aims to examine the overall message gleaned from both events.

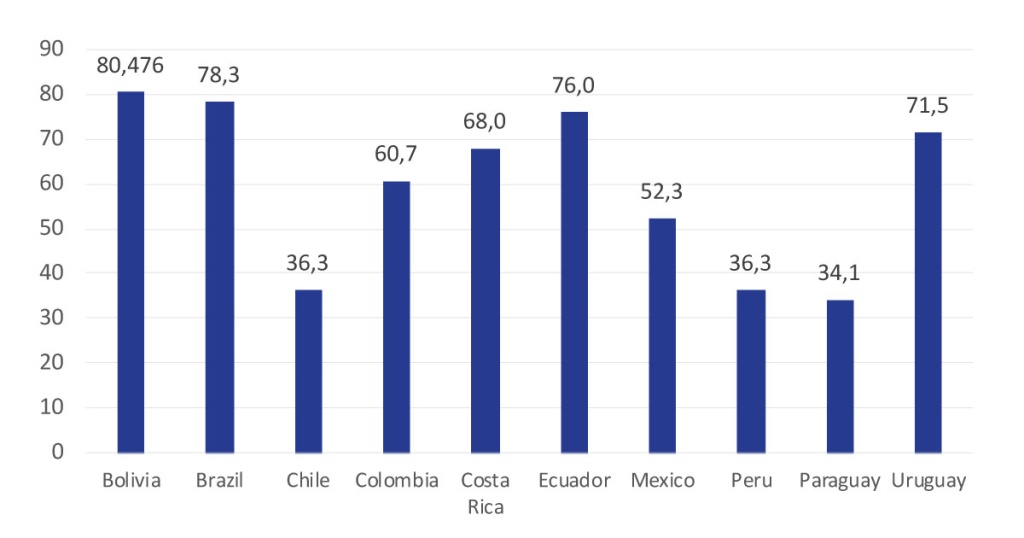

The discussions in both events have shed light on the dangers that come with high levels of public debt (Figure 1). These include a decrease in fiscal flexibility to handle future crises, as well as a decline in economic growth. The discussions have also presented comprehensive strategies that integrate fiscal consolidation, structural reforms, and international collaboration to manage debt and promote sustainable growth effectively.

Figure 1. Public debt (% of GDP)

Source: IMF

The economies of emerging markets (EMEs) have been adversely affected by the implementation of large expenditure packages and decreased revenue collection, creating a necessity to reconstruct their fiscal rooms to withstand potential future shocks. A balanced approach is deemed necessary to support economic recovery without jeopardizing fiscal consolidation. The enhancement of fiscal institutions and the improvement of budgetary frameworks are crucial components of this approach, as they serve to augment transparency, accountability, and efficiency in fiscal management. Additionally, it is imperative to bolster domestic financial markets, prioritize structural reforms that foster productivity and competitiveness, and boost international cooperation to provide debt relief and financing.

The prevailing circumstances of escalating inflation, fluctuating commodity prices, and mounting interest rates have raised apprehensions regarding the sustainability of debt and fiscal policies. Emerging market economies, in particular, are more susceptible to global financial conditions. The confluence of high inflation and rising global interest rates may trigger capital outflows, currency depreciation, and economic instability, compelling these nations to raise their own interest rates, thereby exacerbating the public debt burden and necessitating fiscal austerity measures.

High inflation contributed to reducing fiscal debt in many countries, including Latin American economies. However, the potential short-term benefits emerging from inflation surprises on the public debt-to-GDP ratio are more than offset in the medium and long run in all sorts of economies worldwide. Then, fiscal and monetary policies should coordinate to control inflation and achieve debt sustainability. It is key to preserve the credibility of the macroeconomic and financial policies under the adoption of credible fiscal policy frameworks.

The instability of commodity prices is a serious source of concern for countries that rely on the exportation of these goods. Fluctuations in commodity prices can cause significant variations in export revenues and fiscal balances. This is particularly evident in net commodity-exporting countries, where a decline in commodity prices can lead to a reduction in government revenues. As a result, such countries may need to adjust their fiscal policies, either by reducing expenditures, increasing alternative forms of revenue, or escalating borrowing. These measures, however, can contribute to a rise in public debt levels and precipitate fiscal concerns.

Within the Latin America region, nations are confronted with the arduous task of mitigating fiscal deficits and debt levels, while simultaneously investing in infrastructure and social initiatives, and adapting to the consequences of climate change. To successfully surmount these challenges, Latin American countries must strive to strike a delicate balance between bolstering economic growth and diminishing fiscal deficits and debt levels. This may necessitate the expansion of the tax base, optimizing public services, and directing investments toward infrastructure and social programs that stimulate economic growth and alleviate poverty.

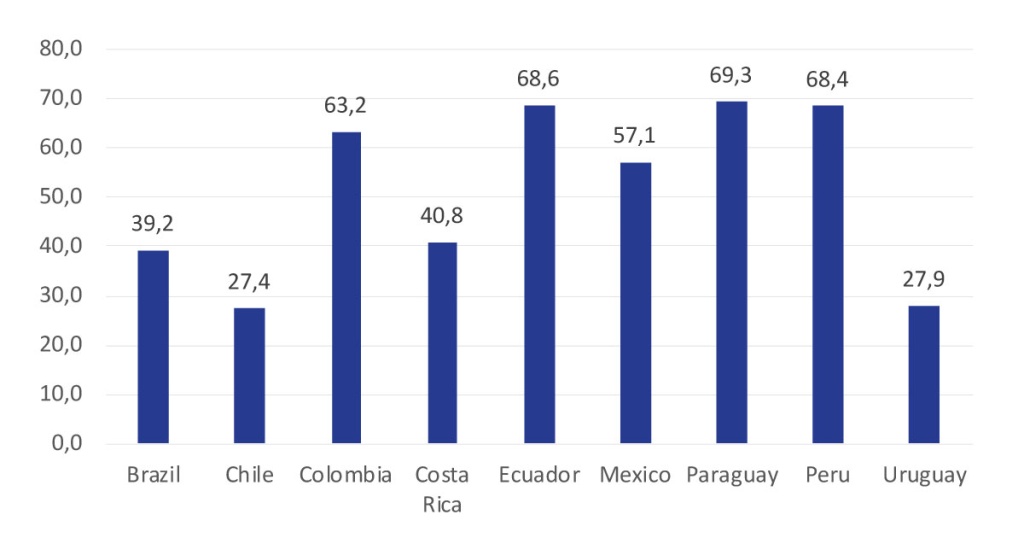

A prevalent issue in the Latin American region is the high level of labor informality (Figure 2), which poses significant challenges to the fiscal consolidation and sustainability of public debt by decreasing tax revenues and undermining social security contributions. To alleviate these effects, it is advisable for governments to streamline tax systems and reduce administrative burdens to encourage formalization. In addition, the implementation of social protection policies that do not depend on formal employment may provide a safety net for informal workers and simultaneously diminish the incentives for informality.

Figure 2. Proportion of informal employment 2021 (%)

Source: International Labor Organization (ILO)

To sum up, the post-pandemic era poses a distinctive challenge for economies globally, particularly those in Latin American nations. This time is not different, and the fiscal policy must do the homework. In connection with this, the challenge ahead is two-fold: addressing the present fiscal stress and high public debt and preparing for any potential future shocks. Though the obstacles may be monumental, they are not impossible. As emerging market economies navigate the path toward fiscal resilience, international cooperation and shared learning will play a vital role in ensuring sustainable growth in the current times.

References

FLAR (May 29, 2023) FLARtalks. “Fiscal Buffers in the Post-Pandemic Era” Online: https://youtu.be/cvqswuSly-8?t=3607